Quote of the day

Andrew Gelman, “Correlation does not even imply correlation.” (Andrew Gelman)

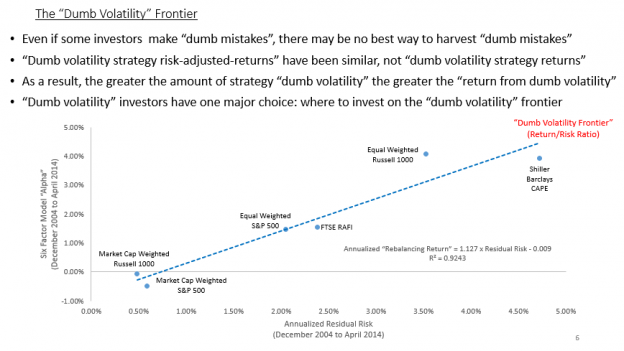

Chart of the day

Where do you want to be on the “dumb money” frontier? (SSRN)

Markets

Is the junk bond correction over? (Income Investing also Crossing Wall Street)

What happens when companies stock buying back so many shares? (Henry Blodget)

Why is there still unconditional love for US stocks? (Pension Partners)

Strategy

There are few common threads among each year’s “perfect portfolios.” (Millennial Invest)

Mean reversion strategies work with closed-end fund discounts. (SSRN)

How to make your investment acumen known to the wider world. (Aleph Blog)

Companies

Gannett ($GCI) is splitting its newspaper and broadcasting assets. (Dealbook, Quartz)

Why are FedEx ($FDX) and UPS ($UPS) relying so much on the USPS? (WSJ)

On the jockey between 21st Century Fox ($FOXA) and Time Warner ($TWX). (Dealbook)

Finance

Now bank venture funds want a piece of the new wave of fintech startups. (Digits)

What does insider trading mean when a hedge fund helps make a takeover bid for a company? (Dealbook)

Goldman Sachs ($GS) is going to kick some low profit hedge fund primer brokerage clients to the curb. (WSJ)

Some hedge fund managers are going a different way on fees. (Conor Sen, Pragmatic Capitalism, Bloomberg)

ETFs

When is an ETF not an ETF? (ETF)

On the parallels between alternative rock and alternative investments. (InvestmentNews)

Global

What are European companies doing with their cash? (FT Alphaville)

Asian companies have their own cash hoarding problem. (Real Time Economics)

Abenomics is working for Japanese women. (FT Alphaville)

Economy

The ISM non-manufacturing data for July show the service economy on fire. (Bloomberg, Calculated Risk)

Earlier on Abnormal Returns

What you might have missed in our Monday linkfest. (Abnormal Returns)

Mixed media

How a resilient attitude leaves you open to good luck when it comes your way. (A VC)

Why a little pessimism may be a good thing for your mental health. (WSJ)

Are PGA players risk-averse? (Alpha Architect)

You can support Abnormal Returns by visiting Amazon. Don’t forget to follow us on StockTwits and Twitter.