Quote of the day

Richard Thaler, “If you want to get somebody to do something, make it easy. ” (Conversable Economist)

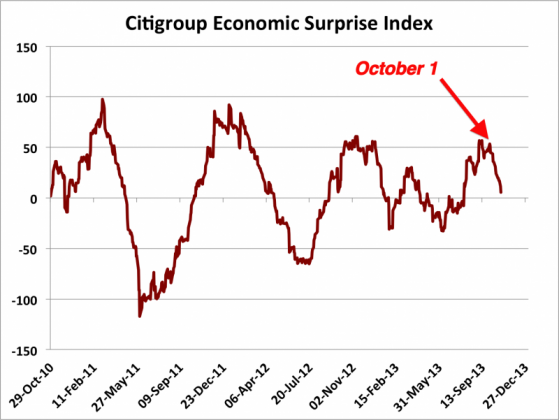

Chart of the day

The Citigroup Economic Surprise Index is about to turn negative. (Business Insider)

Markets

Q3 earnings have been disappointing. (Pragmatic Capitalism)

The Nikkei is at an interesting juncture. (Charts etc.)

Breadth participation by market cap. (Dynamic Hedge)

The case for value stocks. (Institutional Investor)

When high momentum stocks crack, pay attention. (Minyanville)

Strategy

How your stop-loss orders get messed with. (Brian Lund)

“Only a small percentage of traders are actually serious about trading.” (Mercenary Trader)

Quantitative techniques need not be about “black boxes.” (Turnkey Analyst)

Random stuff happens. Don’t let is drive your decision making. (Bucks Blog)

Balanced fund investors have done themselves the least amount of damage through poor timing. (Morningstar)

Companies

Apple’s Q4 in charts. (TechCrunch)

Apple is in a lull. The question is when to get worried. (SplatF)

Google ($GOOG) now wants to dominate livestreamed video. (The Verge)

Aero has a big problem: antennae are power hogs. (WSJ also GigaOM)

Why McDonald’s ($MCD) kicked Heinz ketchup to the curb. (The Daily Beast)

Finance

Is the slow down in M&A secular not cyclical? (Dealbook)

The secondary market for pre-IPO shares has dried up. (WSJ)

Pay attention to land prices to suss out a real estate bubble. (Businessweek)

More hedge fund replication ETFs are coming. (IndexUniverse)

Earlier on Abnormal Returns

What you may have missed in our Monday linkfest. (Abnormal Returns)

Mixed media

James Altucher, “Everyone is wrong almost all of the time and it makes zero sense to argue with them.” (Altucher Confidential)

What your Facebook ($FB) network imply about your relationship potential. (Bits)

Where married couples met. (Priceonomics Blog)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.