Quote of the day

Milk Trader, “Building the model is not the difficult part. It’s analyzing the model…where things can get a little complicated.” (Milk Trader)

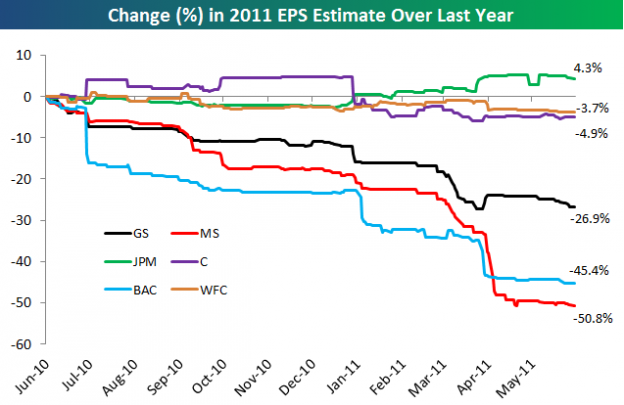

Chart of the day

No wonder the big bank stocks are stuck in the mud. Earnings expectations continue to tank. (Bespoke)

Markets

US companies are back to their share buyback ways. (FT, Ticker Sense)

When sovereign credit risk reigns, there are few places to hide. (SurlyTrader)

Fed days under ZIRP. (Bespoke)

The volatility story behind the VIX. (FT Alphaville)

Falling oil prices have put a bid under the transportation stocks. (MarketBeat)

Who owns the US stock market? (Global Macro Monitor)

Strategy

Is technical analysis simply momentum investing? (Aleph Blog)

Schadenfreude is not an attractive feature for investors. (The Reformed Broker)

Investing done right should be dull. (Bucks Blog)

Just how hard is trading? (Crosshairs Trader)

James Picerno, “At the very least, MPT is a useful guideline for building portfolios, managing risk, and putting the various choices in perspective.” (Capital Spectator)

Cash to market cap was a great trade. However how many people took it? (Falkenblog)

Two takes on market valuation traps. (Value Restoration Project, Pacific Capital)

Have pension funds shot themselves in the foot by trying to achieve unachievable returns? (SSRN, Pension Pulse)

Companies

The financial stocks still represent a value trap. (Mish)

Groupon is not going to enjoy being a public company. (Felix Salmon)

Will there eventually be just one big, global beer company? (Dealbook, Economist)

Hedge funds

How one manager made money off of a failed deal. (Insider Monkey)

A number of big hedge funds are struggling, but not Bridgewater Associates. (FT, Dealbreaker)

ETFs

Who worried should we be about ETF settlement failures? (IndexUniverse)

Stars vs. stars: the Morningstar approach. (Morningstar)

A neat ETF money flow visualization tool. (Symmetric Info)

China

China might actually be serious about diversifying away from the US dollar. (FT)

The bear case on Yoku ($YOKU). (Stone Street Advisors)

More Chinese IPOs are coming down the pike. (Forbes)

More doubts are raised about Sin0-Forest. (FT Alphaville, ibid, Zero Hedge)

At some point the market will cull the real companies from the frauds in China. (The Fly)

Greece

How would it work if Greece left the Euro? (Marginal Revolution)

Why bailing out Greece is such a bad idea. (Curious Capitalist)

Economy

The misery index illustrated. (research puzzle pix)

The drop in commodity prices has reduced the pressure on consumers. (Bespoke)

Household deleveraging and the housing market. (Pragmatic Capitalism, ibid)

What exactly is the implied inflation rate derived from TIPS? (FRBSF also All Star Charts)

The Fed did a poor job in explaining how QE2 would work. (A Dash of Insight)

Earlier on Abnormal Returns

The market thinks the Fed is on hold. Any hint of change from the FOMC could roil markets. (AR Screencast)

What you missed in our Tuesday morning linkfest. (Abnormal Returns)

Mixed media

Barry Ritholtz sits down with the StockTwits crowd. (Big Picture)

The FlyOnTheWall case shows the big banks still don’t get social media. (Howard Lindzon)

Grilled cheese sandwiches as a technology platform. (Bits)

Abnormal Returns is a founding member of the StockTwits Blog Network.