Quote of the day

Carl Richards, “It may seem counterintuitive, but if you have something in your portfolio that you’re complaining about, it’s a good sign you’ve built a diversified portfolio.” (Bucks Blog)

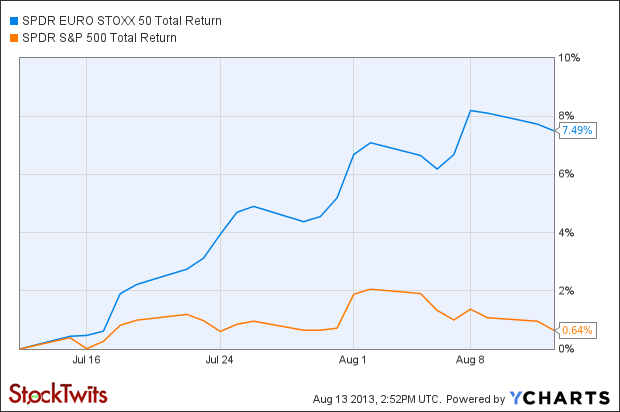

Chart of the day

FEZ Total Return Price data by YCharts

Europe has been taking it to the US the past month. (The Reformed Broker)

Markets

Closed-end fund discounts are at “abnormal” levels. (Focus on Funds)

What are normal interest rates today? (Minyanville)

We are in the midst of a big bull market without a 20% correction. (Big Picture)

Dividends do NOT make up 90% of equity investor returns. (Crossing Wall Street)

Are hot IPOs a sign of an overheated market? (Mark Hulbert)

Strategy

Despite the rise of passive investing, there is no shortage of active managers these days. (Bason Asset)

Not all MLPs are created alike. (In Pursuit of Value)

Ten insights from Mark Douglas, author of Trading in the Zone: Master the Market with Confidence, Discipline and a Winning Attitude. (ST50)

Companies

AMC Networks ($AMCX) has changed the market for serial dramas. (Quartz, Variety)

How Blackberry ($BBRY) went from hero to zero. (Daniel Gross)

Should Amazon ($AMZN) shareholders worry about Bezos and the Washington Post? (Term Sheet)

Finance

The credit crunch is officially over. (Fortune)

Why are 401(k) plans voluntary? (Rekenthaler Report)

A look at the Third Point Reinsurance Ltd. ($TPRE) S-1. (The Brooklyn Investor)

Research shows that hedge funds are doing the heavy lifting for other investors. (Justin Fox)

Can YCharts take on Bloomberg among RIAs and hedge fund managers? (RIABiz)

Traders are a target market for Google Glass. (Quartz)

Regulation

Piecemeal regulation of banks is quietly happening. (MoneyBeat)

Janet Yellen has become a more hardline bank regulator over time. (WSJ)

The PCAOB is forcing auditors to tell us more about a company’s books. (WSJ)

ETFs

A complete history of the SPDR Gold Trust ($GLD). (ETFdb)

Blackstone ($BX) has partnered with Fidelity on an alternative asset mutual fund. (InvestmentNews)

Factor investing is taking off. (InvestmentNews)

Oil

Mexico is opening up is energy industry. (FT, Bonddad Blog)

Why are oil prices still so high? (Capital Spectator)

Economy

Why does GDP get so much attention? (Real Time Economics)

Small business optimism ticked up in July. (Calculated Risk)

The Fed

Is Pres. Obama looking at the Fed the wrong way? (Felix Salmon)

Why we should be happy Larry Summers is on the board of Lending Club. (Time)

Four questions for the next Fed chair. (Pragmatic Capitalism)

Earlier on Abnormal Returns

What you may have missed in our Monday linkfest. (Abnormal Returns)

Elon Musk

Everyone is tallyhoing about Elon Musk’s plan for the HyperLoop. (Medium, FT Alphaville, BW, BI, Quartz)

Listen closely when the consensus is against an idea like the Hyperloop. (Phil Pearlman)

Why aren’t there more Elon Musks? (Pando Daily)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.