Quote of the day

Josh Brown, “Beware the sellers of product who speak with certainty about the decade ahead.” (The Reformed Broker)

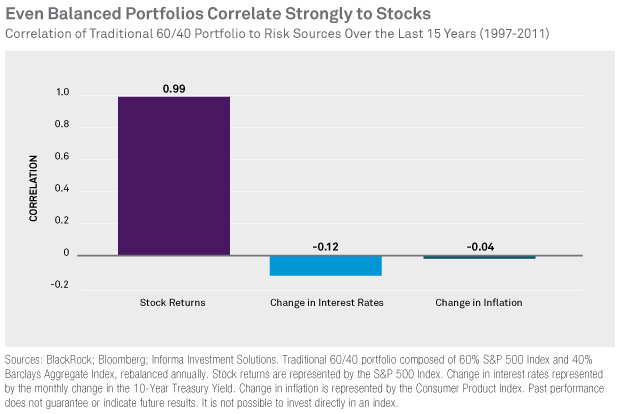

Chart of the day

How a 60/40 balanced portfolio correlates with the S&P 500. (Blackrock via Systematic Relative Strength)

Munis

The spread between AAA and BBB rated munis is falling but still high by historical standards. (InvestmentNews)

Pick your muni mutual fund carefully. (Rick Ferri)

Strategy

Valuation matters when selecting amidst global equity markets. (Greenbackd)

Forget your cost basis. Your decisions should forward looking. (Aleph Blog)

Ten questions with Brian Shannon of AlphaTrends. (Embrace the Trend)

Investors need to look beyond the ticker when buying ETFs. (Forbes)

Four signs your investment is a Ponzi scheme. (Planet Money)

Companies

Can Dell ($DELL) acquire themselves into a software power? (Institutional Investor)

Competition is coming for Amazon’s ($AMZN) cloud business. (Bits)

Why the iPhone 5 is a big deal. (SAI)

Finance

The contours of insider trading are always in flux. (Dealbook)

Criticism aside, private equity is now a $3 trillion global industry. (FT)

How much longer can the SNB defend the peg? (FT Alphaville)

Another look at the big Pimco profile. (Stone Street Advisors)

Hedge funds

Tiger Management alums continue to thrive. (Dealbook)

Prime brokers are asking hedge fund clients to pay up or else. (Reuters)

Hedge funds need to focus on building trust and transparency to keep clients. (All About Alpha)

Economy

Personal income jumps in June. (Calculated Risk)

The Case-Shiller home price index is turning up again. (Calculated Risk, Money Game)

A solution to some of our problems lies in the roughly zero borrowing cost of many governments. (Money Game)

The costs of inflation are just not that high at this point. (Marginal Revolution, Free exchange)

The biggest myth about the Federal Reserve. (Money Game)

The auto industry is demonstrating some confidence in the economy. (NYTimes, Bonddad Blog)

A happy 100th birthday to the late, great Milton Friedman. (Modeled Behavior)

Earlier on Abnormal Returns

Jim Blankenship, “This book should be required reading for anyone who is investing these days – especially for the non-professional investor who is going it alone, without a professional advisor.” (Getting Your Financial Ducks in a Row)

What you missed in our Tuesday morning linkfest. (Abnormal Returns)

Mixed media

Another example why multitasking doesn’t work. (EurekAlert via @markthoma)

Should financial planners shift clients to a retainer model? (Nerd’s Eye View)

Does Twitter understand the “economics of trust“? (BuzzMachine)

Twitter wants to own the $TICKER. (Howard Lindzon also TechCrunch)

Abnormal Returns is a founding member of the StockTwits Blog Network.