Quote of the day

Carl Richards, “The hard part of investing isn’t picking the best investment. Instead, it’s sticking with the one we’ve picked.” (Bucks Blog)

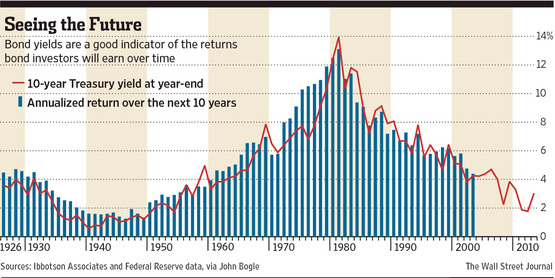

Chart of the day

Want to forecast the next decade’s bond returns? Check out current yields. (WSJ)

Markets

Market moves are never as pat as pundits want you to believe. (The Reformed Broker)

What the ‘ultimate stock pickers‘ are buying and selling. (Morningstar)

Credit

The junk bond rally can’t get much junkier. (FT)

Beware the rapid inflows into bank loan funds. (Bloomberg)

Where should the credit risk premium be today? (Focus on Funds)

Strategy

Why value investing works: it forces you to buy companies that make you want to throw up. (Turnkey Analyst)

It’s a big world: the highly improbable happens all the time. (Above the Market)

Berkshire Hathaway

More thoughts on the Berkshire Hathaway ($BRKB) shareholder letter. (The Brooklyn Investor)

Just how bad was Berkshire’s last five years? (Turnkey Analyst)

How Warren Buffett handles share buybacks. (Aleph Blog)

Finance

Why Puerto Rican bonds are “moving” to New York. (Felix Salmon)

Why forex trading will go electronic: compliance. (FT)

Robots are going to change the nature of insurance. (FT Alphaville)

Funds

Matt Levine, “Even if you have doubts about market efficiency, market meta-efficiency might be enough to turn you off to active management.” (Bloomberg View)

Why not every “smart beta” strategy can outperform the market. (Rick Ferri)

Global

Russian stocks are cheap (for a reason). (Marketwatch, The Short Side of Long, BCA Research)

Economy

Overshooting: what the Fed thinks. (Tim Duy)

Americans continue to buy Ford F-150 pickup trucks. (Bespoke)

Earlier on Abnormal Returns

Quick takes on five recently published finance-related books. (Abnormal Returns)

What you may have missed in our Monday linkfest. (Abnormal Returns)

Mixed media

Why blogs and StockTwits are so important to investors. (Points and Figures)

Why its a big deal that the Ira Sohn Conference teamed up with Bloomberg. (Business Insider)

Ben Horowitz bleeds on the page in The Hard Thing About Hard Things: Building a Business When There Are No Easy Answers. (TechCrunch, Bits)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.