Quote of the day

Mark Thoma, “Unemployment is too high and inflation is too low (and inflation expectations are stable). Why are we talking about tapering?” (Economist’s View)

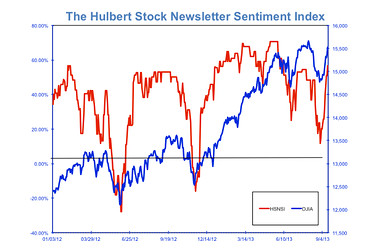

Chart of the day

Market timers are getting really bullish. (Mark Hulbert)

Technicals

Beware the dreaded black candlesticks. (All Star Charts)

New highs expanded yesterday. (Bespoke)

The rally has been broad-based. (Charts etc.)

Where does 2013 rank amongst the best first three quarters of the year? (Avondale Asset)

Markets

What happens after a bull shows up on the cover of Time magazine. (Ticker Sense)

The ultra-rich are uber-confident…maybe too confident. (Minyanville)

There is never a shortage of reasons to go to cash. (The Reformed Broker earlier Abnormal Returns)

The demand for safe assets is waning. (Calafia Beach Pundit)

Seth Klarman is returning money to investors. (Business Insider)

Forward earnings are still headed higher. (Dr. Ed’s Blog)

Muni bonds

Muni bonds are attracting crossover buyers. (FT Alphaville)

Check out the drawdown in the muni bond space. (Mebane Faber Research)

Muni bond closed-end funds are trading at big discounts. (WSJ via Turnkey Analyst)

Bonds

Understanding what it means to roll down the yield curve. (Inside Investing)

Checking in on a corporate bond market in “overdrive.” (Minyanville)

Investors are still wicked bearish on bonds. (The Short Side of Long)

Apple

Why do analysts think Apple ($AAPL) is always on the precipice of doom? (Monday Note)

Is Apple now just another “typical American corporation“? (Guardian)

Horace Deidu on why outsiders don’t understand Apple. (Eric Jackson)

Why didn’t Apple price the 5c lower? (The Exchange)

How Twitter makes money. (Reuters)

Twitter was mobile before mobile was cool. (Bloomberg)

Twitter isn’t another social company. (HBR)

Twitter is going to have to “appeal to normals.” (Fast Company)

How many fake accounts does Twitter have? (Business Insider)

Companies

Microsoft ($MSFT) increases its cash output to shareholders. (Slate, WSJ, Bloomberg)

Starbucks ($SBUX) is getting a tad overvalued. (Crossing Wall Street)

Finance

The end of Lehman Brothers is still no in sight. (Quartz)

Why JP Morgan ($JPM) should be split in three parts. (Fortune)

Even boutique banks are not free of conflicts of interest. (Term Sheet)

Why endowments should resist the move to divest themselves from fossil fuel-related investments. (Institutional Investor)

ETFs

There are a lot of alternatives to the big emerging market equity ETFs. (IndexUniverse)

Economy

How the taper could affect the rest of the world. (Institutional Investor)

Home builders are still pretty optimistic. (Calculated Risk)

Some good news on fracking. (Businessweek)

Earlier on Abnormal Returns

What you may have missed in our Monday linkfest. (Abnormal Returns)

Mixed media

How to be a little bit more conscious about your spending. (Bucks Blog)

The antibiotic pipeline is pretty bare. (Wonkblog)

Yet another good reason to live in a “socially cohesive neighborhood.” (Science Blog)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.