Quote of the day

Eddy Elfenbein, “The U.S. stock market isn’t rallying so much as the fear premium is slowly fading away. The net effect, of course, is the same—rising share prices. ” (Crossing Wall Street)

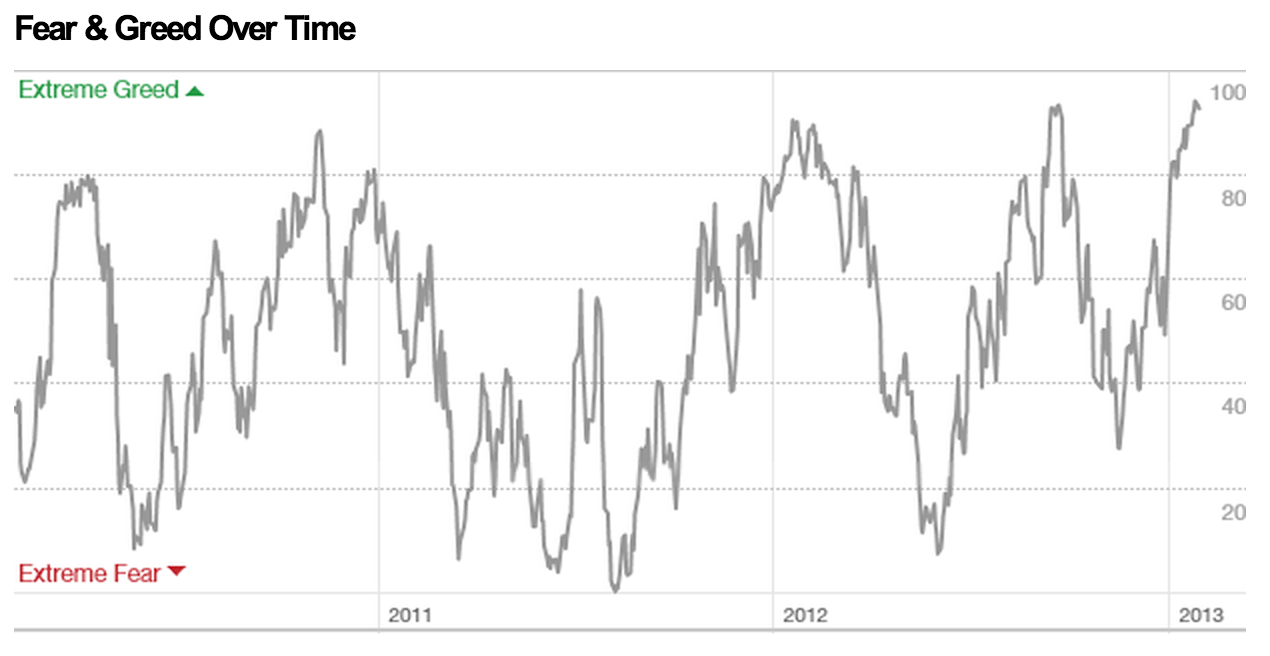

Chart of the day

Markets are feeling little fear. (CNNMoney)

Markets

Is the golden age of stockpicking finally here? (Quartz much earlier Abnormal Returns)

Where did all the market drama go? (The Reformed Broker)

Retail buying need not be the end of the rally. (The Source)

More signs of an overbought market. (Humble Student, Pragmatic Capitalism)

Strategy

Low volatility NFL bets. (Falkenblog)

There’s no holy grail in investing. (Pragmatic Capitalism)

We worry about the wrong risks. (NYTimes)

Asset allocation and rebalancing will get you most of the way there. (Capital Spectator)

Research

Why the time of day matters for company conference calls. (SSRN)

Do fund managers who use technical analysis generate better returns? (SSRN via CXOAG)

Companies

Just how long a shot is a Yahoo! ($YHOO) turnaround? (Pando Daily, WSJ)

Homebuilder stocks have gotten pricey. (Michael Santoli)

What Harley-Davidson ($HOG) says about the US economy. (Wonkblog)

Finance

Why Warren Buffett still likes the banks. (The Brooklyn Investor)

Investors are the big winners of the ETF price war. (Fortune)

Closed-end funds are still the go-to sector for leverage. (Bloomberg)

Global

Why India is right to start cutting rates. (Quartz)

Canadian banks are getting downgraded on fears of a housing bubble. (FT)

Italy has a gambling problem. (The Daily Beast)

China is losing its edge as a low-cost manufacturer. (ValuePlays)

Economy

Case-Shiller points toward higher housing prices. (Calculated Risk also WashingtonPost)

Are Americans becoming more empirical? (Big Picture)

Mixed media

Big changes are coming to StockTwits. (StockTwits Blog)

Streaming will not put food on the table of the vast majority of artists. (NYTimes, Quartz)

McDonald’s ($MCD) stores are for some wi-fi hotspots of last resort. (WSJ)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.