Quote of the day

David Merkel, “Complexity has a price; avoid it unless well compensated for it.” (Aleph Blog)

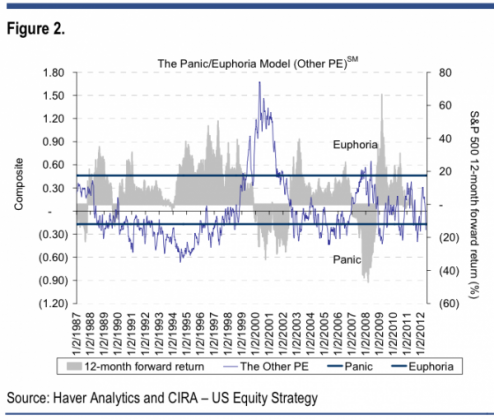

Chart of the day

The return of fear. (Pragmatic Capitalism)

Markets

How the stock market trades around Memorial Day. (CXO Advisory Group)

Josh Brown, ” A stock without a dividend is a baseball card – you can quote me whatever price the book says but we both know its only worth what you can sell it to the next guy for.” (The Reformed Broker)

Foreign VIX-based indices just haven’t taken off. (MarketBeat)

A look at relative sector strength. (Bespoke)

Strategy

Jeff Miller, “Why does a Shiller disciple care about profit margins?” (A Dash of Insight)

Good companies often make for mediocre stocks. (Rick Ferri)

Don’t lose out on the rebalancing bonus. (Capital Spectator)

What are Warren Buffett’s money managers up to? (Morningstar)

How have value investors done in comparison with the “magic formula”? (Greenbackd)

That’s not cool. A Facebook underwriter cut estimates during the company’s road show. (Business Insider, Big Picture, Felix Salmon)

Global social media companies are now all benchmarked against Facebook. (beyondbrics)

Four lessons learned from the Facebook debacle. (Time)

VCs can, and do, get IPOs wrong. (Term Sheet)

Companies

Keep an eye on Apple’s ($AAPL) capital expenditures. (Asymco)

Google ($GOOG) is now a hardware company. (Businessweek, YCharts Blog)

What should we make of Wal-Mart ($WMT) at a new high for the decade? (Crossing Wall Street, Dragonfly Capital)

Notes from the Greenlight Re ($GLRE) annual shareholders meeting. (The Brooklyn Investor)

Think housing will improve? Buy truckers. (Bloomberg)

What does a Chinese conglomerate want with AMC Entertainment, a chain of movie theaters? (WSJ, ibid)

Finance

The tangled web we weave: the JP Morgan ($JPM) edition. (Sober Look)

What, if anything, would the reintroduction of Glass-Steagall do for the TBTF problem? (Dealbook)

Save finance: abolish mortgage-backed securities. (The Atlantic)

ETFs

Are low volatility funds, like the PowerShares S&P 500 Low Volatility ($SPLV), just the flavor of the week? (WSJ)

The AdvisorShares Dent Tactical ETF is closing down. (ETF Trends)

On the issue of “phantom ETF shares.” (FT Alphaville)

Funds

Do quant models need more of a human touch? We will soon find out. (WSJ)

Should index investors care about voting rights? (IndexUniverse)

One big asset manager is recommitting to the mutual fund business. (Bloomberg)

Did TIAA-CREF just launch the future of institutional investment? (Institutional Investor)

Global

There is no end in sight for the LTRO. (Crackerjack Finance)

The BRIC countries are hitting a wall of their own making. (The Atlantic)

Pessimism takes hold in China. (Finance Addict)

Economy

More signs the housing economy is turning. (Calculated Risk, Calafia Beach Pundit)

What the Fed has learned during the financial crisis about how expectations affect the inflation outlook. (WSJ)

Americans have still not returned to their old driving ways. (Calculated Risk)

Earlier on Abnormal Returns

Part two of my discussion with Aaron Klein CEO of Riskalyze. (Riskalyze)

What you missed in our Tuesday morning linkfest. (Abnormal Returns)

Mixed media

Spend your money on ways to make yourself happier not on “plastic crap.” (Bucks Blog)

The SpaceX launch of its Dragon capsule was impressive by all accounts. (Space, Money & Co.)

The Harvard Business School of China. (Fortune)

Abnormal Returns is a founding member of the StockTwits Blog Network.