Quote of the day

Emanuel Derman, “Provide golden parachutes for no one; provide tin parachutes for everyone.” (Reuters)

Chart of the day

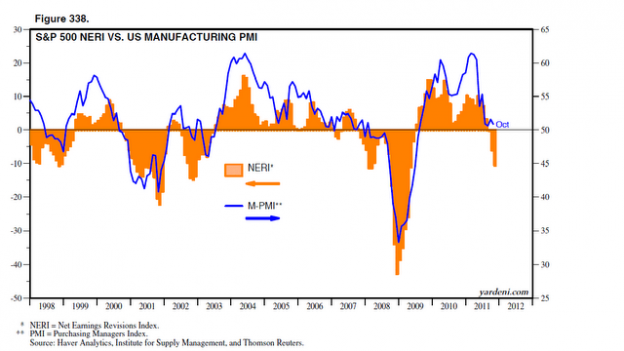

Not so great news on the earnings revision front. (Dr. Ed’s Blog)

Markets

Don’t buy Japan just yet, Warren. (Dragonfly Capital)

Two measures of volatility are telling different stories. (Investing With Options)

A tale of two lost decades. (Vanguard Blog)

Research

How to calculate really long term return projections. (Turnkey Analyst)

A look at some alternative weighting schemes. (Advisor Perspectives via Systematic Relative Strength)

Should we care about the correlation between Facebook followers and stock returns? (Falkenblog)

Companies

The long, strong history of Nike ($NKE). (Crossing Wall Street)

Apple ($AAPL) could be the world’s leading “PC maker” in 2012. (GigaOM, TechCrunch)

The iPhone needs more carriers. (Apple 2.0)

More signs the shipping industry is in trouble. (Bloomberg, Telegraph)

Gilt Groupe is planning to go public in 2012. (FT)

Finance

Hank Greenberg wants an AIG ($AIG) do-over. (Dealbreaker, Kid Dynamite)

Jeffries Group ($JEF) seems to be winning the battle, for now. (NetNet)

Royalty trusts are becoming increasingly popular financing vehicles for oil companies. (FT)

There is life after finance. (Dealbreaker)

Funds

Should we be all that impressed by Bill Miller’s performance streak? (FT Alphaville also Can Turtles Fly?)

Hedge funds are hip deep in ETFs. (Institutional Investor)

Should we be all that concerned with rising hedge fund correlations? (Insider Monkey)

Slicing and dicing all 31 VIX ETPs. (VIX and More)

Global

French yields are blowing out. (Bloomberg)

Germany is not the exemplar of fiscal rectitude commonly thought. (Der Spiegel via Economist’s View)

Central Europe is about to feel the effects of bank deleveraging. (FT Alphaville)

Why the rest of the world may not be crazy about ECB bond buying. (The Source)

Risk off equals tough times for emerging currencies. (Crackerjack Finance)

Mongolia is going to be the fastest growing economy in the world. Too bad there are no good ways to play it. (Money Game)

Economy

3Q GDP was revised lower. (Calculated Risk, Economist’s View, Free exchange, EconomPic Data)

Inflation expectations are dipping again. (Capital Spectator)

This indicator is showing a perfectly average recovery. (Money Game)

Robert Shiller on the neuroeconomics revolution. (Project Syndicate)

Earlier on Abnormal Returns

Share buybacks and opportunities lost. The case of Netflix ($NFLX). (Abnormal Returns)

What you missed in our Tuesday morning linkfest. (Abnormal Returns)

Mixed media

A review of Mitch Zacks’ The Little Book of Stock Market Profits: The Best Strategies of All Time Made Even Better . (Reading the Markets)

Why we all need a financial co-pilot from time to time. (Bucks Blog)

Business TV is not built to explain an increasingly complex world. (Interloper)

Abnormal Returns is a founding member of the StockTwits Blog Network.