Quote of the day

Jason Fried, “Skip steps now, you’ll skip them later. Cut corners now, you’ll cut them later. You get used to what you do most of the time.” (37signals)

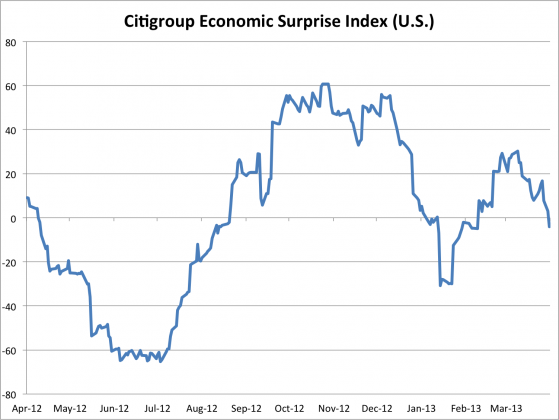

Chart of the day

The Citigroup Economic Surprise Index just turned negative. (Money Game)

Markets

Risk has once again flared in the markets. (SurlyTrader)

Comparing today’s market to 2000 and 2007. (FT Alphaville)

Oil’s sell-off is behind that of the metals. (FT Alphaville)

A scad of good earnings reports this morning. (Money Game)

Gold

How much longer does the “real asset unwind” have to go? (Behavioral Macro)

Gold’s fair value: $800. (Mark Hulbert)

Six theories on the decline in gold. (Rational Irrationality also Econbrowser)

Is this the end of the fear bubble? (Felix Salmon)

The ten rules of goldbuggery. (Big Picture)

Gold miners

A new measure of gold miner costs is not pretty. (FT Alphaville)

Gold miners have not hedged enough. (MoneyBeat)

Gold miners still look ugly. (Breakingviews)

Gold ETPs

Did you know there were synthetic gold ETPs? (Quartz)

Is money flowing out of gold ETFs? (MoneyBeat)

Strategy

A good lesson from the gold round-trip: rebalance. (Capital Spectator)

More information=more confidence=more problems. (Turnkey Analyst)

Companies

Why Apple ($AAPL) is plumbing new lows. (Business Insider, research puzzle pieces)

How much cash could Apple shovel back to shareholders? (MoneyBeat)

Can Intel ($INTC) overcome the PC slump? (Quartz, GigaOM)

Finance

Ten big private equity tax loopholes. (Dealbook)

Vanguard continues to lead the pack in pulling in assets. (InvestmentNews)

The shift towards electronic bond trading is accelerating. (WSJ)

Funds

Why your ETF index provider matters. (IndexUniverse)

Doubleline is set to launch another cl0sed-end fund. (InvestmentNews)

Global

China is reaching its ‘Pettis moment.’ (FT Alphaville)

Why have central banks been buying gold? (Quartz)

Economy

Housing starts accelerate in March. (Bloomberg, ValuePlays)

Gasoline prices keep on falling. (Calculated Risk)

Why QE is overrated. (Pragmatic Capitalism)

Mixed media

Lessons from Boston: Keep calm and carry on. (The Atlantic)

Even doctors need a nudge to remind them to wash their hands. (Bloomberg)

Take twenty minutes of meditation and call me in the morning. (WSJ)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.