Quote of the day

Howard Lindzon, “I don’t trust Warren Buffett, but I don’t trust anyone with my money.” (Howard Lindzon)

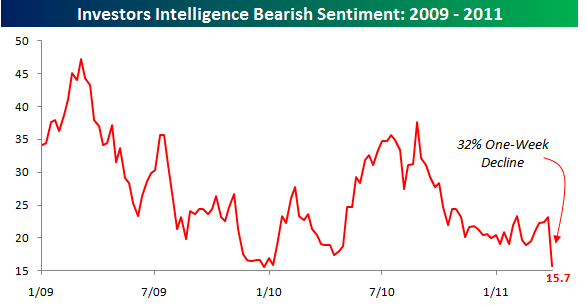

Chart of the day

Investor’s Intelligence survey shows a dearth of bears. (Bespoke also @sentimentrader)

Markets

The “real stock market” already is at new highs. (Trader’s Narrative also Crossing Wall Street)

Unconstrained bond mandates are fine, provided managers… (Aleph Blog)

What the Loomis Sayles guys think about the bond market. (Felix Salmon)

On the prospect for the return of the yen carry trade. (Minyanville also FT Alphaville)

Commodities

The battle ground that is corn. (The Reformed Broker)

Stunning graphs on the fall in natural gas prices. (Carpe Diem also Econbrowser)

Can you use oil prices to forecast the $USDCAD exchange rate? (SSRN)

Strategy

How mergers can mess with your trading strategy. (Dynamic Hedge)

How should you use historical seasonality data? (Tyler’s Trading)

On the art of trading like a casino. (Rogue Traderette)

If you are a technically-driven swing trader tune out the noise and focus on price and volume. (chessNwine)

Psychology

Cam Hui, “(A)t the end of the day, all you have are your name and reputation.” (Humble Student of the Markets)

James Altucher, “Financial media is financial entertainment. If someone tells you should buy a stock you should take that same money and go on a nice vacation instead.” (Altucher Confidential)

Why we keep getting sucked in by pundits. (Reason, Martin Kronicle)

A summary (and review) of Robert Koppel’s Investing and the Irrational Mind: Rethink Risk, Outwit Optimism, and Seize Opportunities Others Miss. (CXO Advisory Group)

Companies

An activist is getting antsy waiting for CVS (CVS) to move. (CNBC)

What went wrong at Cisco (CSCO) and how it can be fixed. (GigaOM also MarketBeat, Forbes)

What is Dish (DISH) going to do with Blockbuster? (Atlantic Wire)

Using Sotheby’s (BID) stock as a economic indicator. (Atlantic Business)

IPOs

How the US got left behind in the global IPO game. (SSRN)

The numbers behind the bounce back in the IPO market. (peHUB)

Hedge funds

Why hedge funds aren’t worth the time (or money). (ROI)

Michael Steinhardt on the changes in the hedge fund game over the past ten years. (market folly)

Finance

Pimco plans on launching a REIT. (Bloomberg)

Spend some time thinking about the vulnerabilities of the financial system to cyberattacks. (the research puzzle also Points and Figures)

Five unresolved financial dilemmas from Bethany McLean. (Slate)

Economy

TIPS-derived inflation rates are back to pre-crisis levels. (Calafia Beach Pundit also Crossing Wall Street)

Global economic growth seems to be slowing. (Pragmatic Capitalism, Money Game)

Apartment rents are rising. (Free exchange)

The Fed won’t fall behind the inflation curve any time soon. (Tim Duy)

Tracking the FedHeads. (MarketBeat)

Earlier on Abnormal Returns

On the psychological (and physical) challenges of being a contrarian investor. (AR Screencast)

What you missed this Wednesday morning. (Abnormal Returns)

Mixed media

On the issue of unpaid internships in finance. (FT Alphaville)

A look at some investing apps for the iPad. (VIX and More, ibid)

How to become an expert. In short, practice. (Asymco)

The best four man rotations of all time, including the 2011 Phillies. (NYTimes)

Abnormal Returns is a founding member of the StockTwits Blog Network.