If you haven’t done it already think about signing up for our daily e-mail, thousands of other Abnormal Returns readers already have.

Quote of the day

Jon Boorman, “Could you kill that loss in cold blood?” (Alpha Capture)

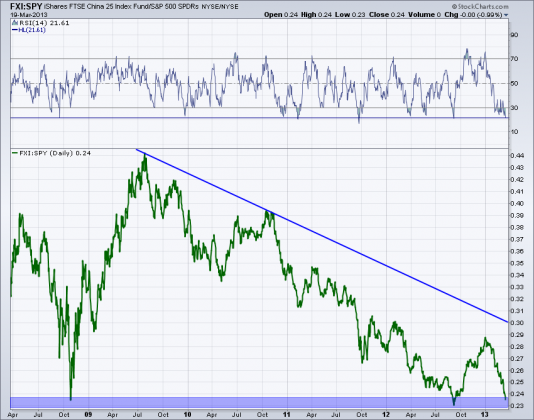

Chart of the day

Can China bounce relative to the S&P 500? (Andrew Thrasher)

Markets

Where will the safe haven cash go? (All Star Charts)

Emerging markets are diverging from the developed markets. (beyondbrics)

Sector performance YTD has not been pretty for technology and materials. (StockCharts Blog)

What is driving market sentiment? (Big Picture)

Commodities

It’s do or die time for gold. (The Reformed Broker)

Why isn’t gold ripping higher on Cyprus news? (Focus on Funds)

Mining stocks are having a tough time of it. (FT Alphaville)

Pension funds like Calpers are souring on commodities. (FT)

Strategy

Calpers is reconsidering paying active management fees. (InvestmentNews)

Hey traders, for the sake of your back don’t forget to get up and move around. (SMB Training)

Some notes on Andrew Abraham’s The Bible of Compounding Money: The Complete Guide to Investing with World Class Money Managers. (CXO Advisory Group)

Companies

Google ($GOOG) is eating the Internet. (Phil Pearlman also Bronte Capital)

How Amazon Prime became bigger than anyone expected. (Time)

Even if you don’t click on them Facebook ($FB) ads are working. (Slate)

Nobody wants an iWatch or Google Watch that doesn’t work as advertised. (Pando Daily)

The Square experiment at Starbucks ($SBUX) is having some problems. (Fast Company, SplatF)

Lululemon’s ($LULU) biggest problem isn’t its pants, it’s rising competition. (The Atlantic)

FedEx ($FDX) is cutting guidance. (Bloomberg, Quartz, Money Game, chessNwine)

Hedge funds

The hedge fund industry is all about size these days. (II Alpha)

The SEC is investigating hedge fund and PE expenses? (WSJ)

Ten activist investors you should know. (Quartz)

Finance

How did American Airlines end up issuing muni debt? (Learn Bonds)

Wealthfront raises a big financing round. Can it transform investment management? (Pando Daily)

There is no doubt all markets are interconnected, even startups. (Howard Lindzon)

Financial crisis or not, nothing much has changed with the big banks. (Dealbook)

ETFs

How have BRIC fund offerings fared? (Morningstar)

In praise of the Fidelity-Blackrock ($BLK) deal. (IndexUniverse)

What’s behind the MLP ETP boom? (IndexUniverse)

Does minimum volatility strategies make sense in the emerging markets? (Morningstar)

Real estate

Architects are busy. (Calculated Risk)

Houses are getting bigger again. (Real Time Economics)

Rental units is still driving construction activity. (Fortune)

Farmers are up against investors for farmland. (NYTimes)

Earlier on Abnormal Returns

What should we be worried about? The many failures of the personal finance industry. (Abnormal Returns)

Mixed media

Hand your brackets over to a computer if you hope to win your pool. (Pando Daily)

How to create an optimal workout playlist. (Scientific American)

As a band if you want to break big go on Conan. (Forbes)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.