If you haven’t done it already think about signing up for our daily e-mail, thousands of other Abnormal Returns readers already have.

Quote of the day

Alice Schroeder, “(I)f the public ever revolts against the corporate nation-states, the one company that probably is safe from retribution is Berkshire Hathaway.” (Bloomberg)

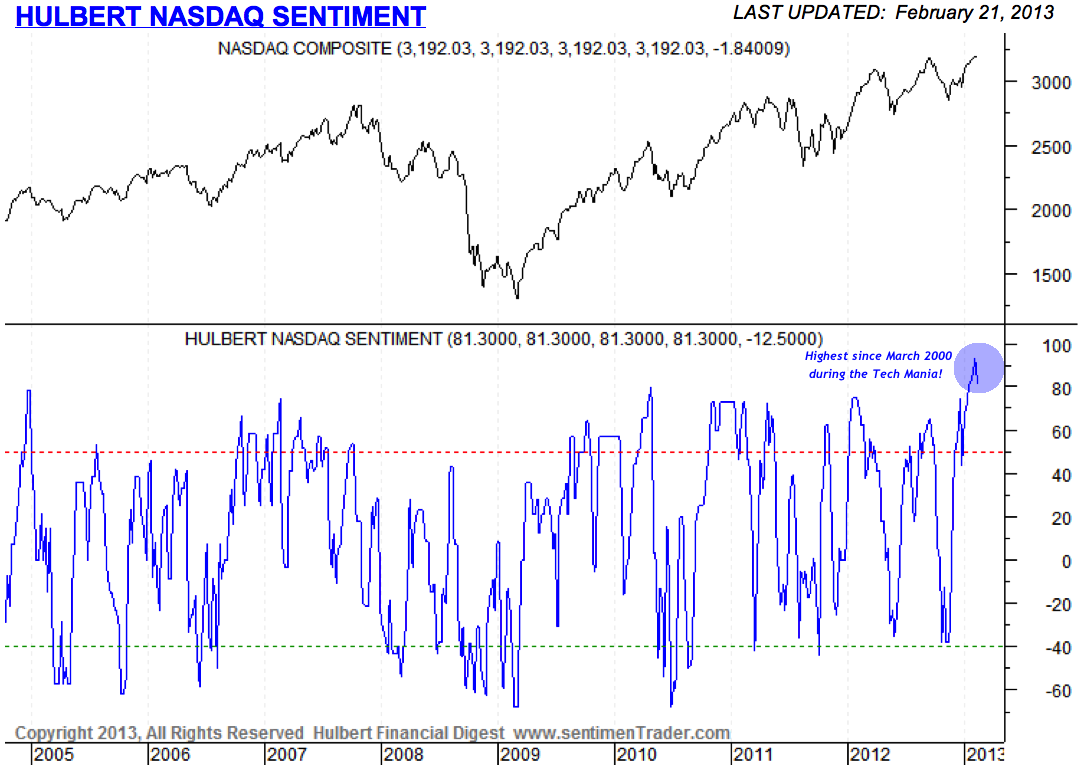

Chart of the day

Investment advisers are pretty darn bullish. (The Short Side of Long)

Markets

On the strange action in the $VIX this week. (FT Alphaville also VIX and More)

Does the market do better when it is near new highs (or lows)? (World Beta)

Why currency moves have gotten so tricky to call. (MarketBeat)

Should we fear the disconnect between durable goods and the S&P 500? (Pragmatic Capitalism)

Strategy

How many screens do traders need? (Howard Lindzon)

Beware offering that claim to be “just like a CD.” (Bucks Blog)

Checking in on ‘lazy portfolios.’ (Marketwatch)

Online

Is Twitter really worth $10 billion? Maybe more. (WSJ)

The mobile payment space is getting crowded. (AllThingsD)

Buying stuff online is getting easier. (Felix Salmon)

Companies

Perceptions about Apple ($AAPL) have changed 180 degrees. (Daring Fireball)

Is this the Achilles heel of Google Glass? (Quartz)

Is the end of the cable bundle near? (WSJ also The Atlantic)

Finance

Private equity managers just love to do deals. (Term Sheet)

On the unintended consequences of a financial transactions tax. (Dealbook also WashingtonPost)

A review of JP Morgan’s ($JPM) investor day. (The Brooklyn Investor)

ETFs

The downside of a surge in interest in leverage loan funds. (FT)

Brokerage firms are sitting on a treasure trove of data on customer ETF behaviors. (FT)

A look at some multi-asset ETFs. (ETFdb)

Economy

A mixed bag for January durable goods orders. (Capital Spectator)

Signs of consumer stress. (Humble Student)

How shrinking housing inventories could push home prices higher. (Modeled Behavior also ValuePlays)

More evidence that housing has bottomed. (Calafia Beach Pundit)

Work

On the benefits of working remotely. (Slate also Herb Greenberg)

The competition for not-for profits jobs is fierce. (Quartz)

Want more jobs? Pass the startup visa act. (Felix Salmon)

Only half of first-time college students graduate in six years. (Economix)

Mixed media

An increasing number of young adults still live at home. (The Atlantic)

New Jersey legalizes Internet gambling. (WSJ)

How to be a better driver. (Scientific American)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.