Quote of the day

Jason Zweig, “It takes years of deliberate effort for investors to become even partially effective at counteracting their own genetic biases.” (Total Return)

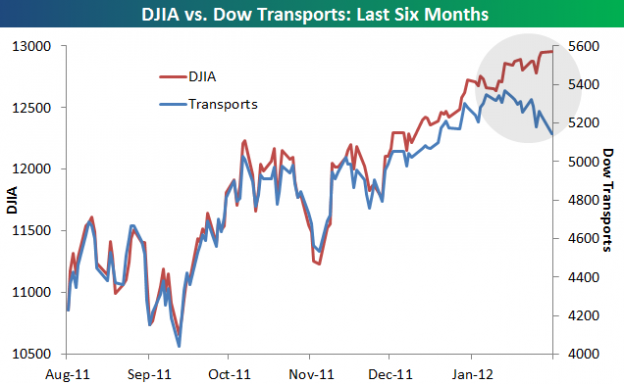

Chart of the day

The ongoing divergence between the Dow Industrials and Transports. (Bespoke also Tyler’s Trading)

Markets

Up to a point the stock market wants more inflation. (Crossing Wall Street)

A look at the positive relative strength of the energy sector. (All Star Charts)

Another look at pairwise asset correlations by market. (All About Alpha)

The Dow is for most purposes just fine, thank you. (Free exchange)

Media headlines will lead investors to ruin. (StreetTalk Live)

Strategy

Why traders constantly subvert their own processes (and success). (SMB Training)

On the benefits of portfolio rebalancing. (Capital Spectator)

Research into an enhanced dollar cost averaging strategy. (SSRN)

Why does the currency carry trade work? (Buttonwood)

Religion and stock price crash risk. (SSRN via Money Game)

Technology

Why Microsoft ($MSFT) should embrace the iPad. (Fast Company, AppleInsider)

Why Apple ($AAPL) should buy Yahoo! ($YHOO). (Eric Jackson)

How much does it cost to build an iPhone? (Asymco)

Everything is a gadget now. (SplatF)

Finance

How the Volcker Rule could recreate Glass-Steagall. (Dealbook)

Three plus years into bankruptcy, Lehman Brothers still lives. (research puzzle pix)

Wall Street is gearing up for credit ratings downgrades. (Term Sheet)

Checking in on the most crowded hedge fund positions. (Street of Walls)

ETFs

Why does the iShares S&P National AMT-Free Municipal Bond ETF ($MUB) trade at a premium to NAV? (Morningstar)

What happens next with $TVIX? (Kid Dynamite)

Now the SEC is sniffing around ETFs. (Reuters)

Global

Why savings rates spiked during the Great Recession. (voxEU)

The Aussie dollar is weakening, look out Euro stocks. (The Source)

Hold your applause for the Greek debt deal. (Felix Salmon, ibid)

Other markets have big elections coming up in 2012. (MarketBeat)

Economy

Just how much “pent up demand” is there in the US consumer economy? (FT Alphaville)

What is going on with housing inventories? (Big Picture)

Agriculture subsidies are scrutinized amidst a farm boom. (FT)

Earlier on Abnormal Returns

Controversy is catnip for the financial media. (Abnormal Returns)

What you missed in our Wednesday morning linkfest. (Abnormal Returns)

Mixed media

Look out Facebook, “interest-based social networks” like StockTwits are the new, new thing. (TechCrunch also Howard Lindzon)

In praise of Reid Hoffman and Ben Casnocha’s The Start-up of You![]() . (EconLog)

. (EconLog)

All the incessant talk ABOUT television ruining the viewing experience. (Atlantic Wire)

Abnormal Returns is a founding member of the StockTwits Blog Network.