Don’t miss out! You can keep up with all of our posts by signing up for our daily e-mail. Thousands of other readers already have.

Quote of the day

Julie Segal, “Chefs can’t learn their craft from the couch by simply imitating the steps of Julia Child any more than investors will uncover the secret to finding alpha by mimicking the steps of Peter Lynch or David Swensen.” (Institutional Investor)

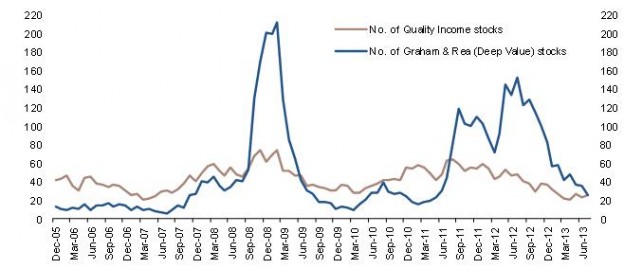

Chart of the day

Where did all the deep value stocks go? (Mebane Faber Research)

Markets

The bond market is on track for it’s worst year in four decades. (Quartz)

Why are secondary offerings viewed as negative events. (Ivanhoff Capital)

Some more risk-on indicators. (Charts etc.)

Behold the volatility on Fed days. (MoneyBeat)

Strategy

Notes from the Value Investors Conference: New York 2013. (Market Folly)

Why investors so focus on downmarket performance. (SSRN)

Four things Twitter needs to do before its IPO. (Fortune)

The challenge Twitter faces in turning new users into addicts. (stratechery)

Critics are focusing on the wrong thing with the Twitter IPO. (Term Sheet)

Autos

Tesla ($TSLA) wants to launch a self-driving car. (FT)

GM ($GM) wants to cut the cost of batteries to beat Tesla. (Quartz)

Apple

Uncle Walt (and Pogue) love the new iPhone 5S. (AllThingsD also NYTimes)

The Apple 5S is the fastest phone out there. (AnandTech)

The iPhone 5S is surprisingly (and quietly) innovative. (Daring Fireball)

A comprehensive iOS 7 review. (Pixel Envy)

iTunes Radio is pretty good. (GigaOM)

Researchers are moving beyond fingerprints to secure our digital lives. (Quartz)

Smartphone markets are becoming isolated geographically. (Asymco)

Finance

The market for private equity secondaries is booming. (Institutional Investor)

Predicting FX moves is a “mug’s game.” (MoneyBeat)

ETFs

How the demise of Lehman Brothers helped the ETF business. (IndexUniverse)

The technology behind pricing (and building) ETFs. (FT)

Financial crisis

Where’d all the capex go? (FT Alphaville)

Why aren’t banks lending more? (Felix Salmon)

Martin Wolf, “Lehman’s failure did not cause all this. Its failure was a symptom of imbalances that did.” (FT)

Economy

Why the Fed may not taper mortgage-backed bond purchases. (Bloomberg

How rising interest rates are affecting home buyers? (Capital Spectator also Bonddad Blog)

Earlier on Abnormal Returns

What you may have missed in our Tuesday linkfest. (Abnormal Returns)

Mixed media

Robotic content is less than worthless. (Aleph Blog)

On the pleasures of being a regular. (kottke)

Five (more) reasons you shouldn’t retire. (Random Roger)

Travel sports are a financial disaster. (Pete the Planner)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.