You can keep up with all of our posts by signing up for our daily e-mail. Thousands of other readers already have. Don’t miss out!

Quote of the day

David Merkel, “Most market players don’t think; they mimic.” (Aleph Blog)

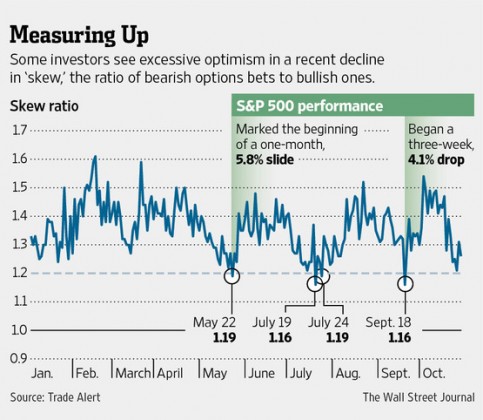

Chart of the day

Where did all the skew go? (WSJ)

Markets

Bearish sentiment has evaporated. (Long Short also Mark Hulbert)

Offensive sectors are leading the market higher. (StockCharts Blog)

Remember when the Fed Model used to work? (Dr. Ed’s Blog)

Strategy

There is a big difference between enthusiasm and fandom. (The Reformed Broker)

Notes from the Invest for Kids Chicago 2013 conference. (Market Folly)

Investors check their accounts more often when the market is higher. (SSRN)

Apple

Apple ($AAPL) should be managed more like Bloomberg. (Felix Salmon)

How many iOS devices will be produced in 2014? (Asymco)

Finance

Crowdfunding rules don’t do enough to protect small investors. (Dealbook)

Why are Internet startups raising so much money so quickly? (Term Sheet)

Hedge funds

Why do hedge funds continue to attract assets? (Howard Lindzon)

Why the hedge fund of fund model is dying. (FT)

ETFs

The challenges Fidelity faces getting into the ETF game. (FT, ibid)

A discussion about Fidelity’s plans for their own ETFs. (IndexUniverse)

Economy

On the prospects for continued high profit margins. (Gavyn Davies also Business Insider)

ADP show continued sluggish private employment growth in October. (Calculated Risk)

How the Internet is changing what economists do. (Mark Thoma)

Earlier on Abnormal Returns

What you may have missed in our Tuesday linkfest. (Abnormal Returns)

Mixed media

The 50 greatest innovations since the wheel. (The Atlantic)

A test drive with the Tesla Model S. (Ars Technica)

The iPad Air is the best tablet, “hands down.” (AllThingsD also Daring Fireball, Pogue)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.