Quote of the day

Ben Carlson, “Mean reversion is conceptually simple to grasp, but harder to figure out in real-time as the mean for most markets and valuation levels is probably a moving target and the timing of the reversion is always subject to change.” (A Wealth of Common Sense)

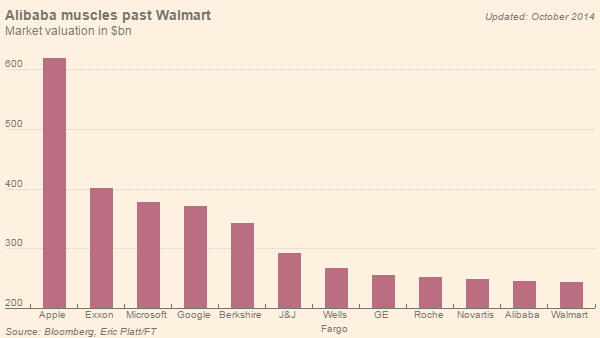

Chart of the day

Alibaba ($BABA) is now bigger than Wal-Mart ($WMT). (FT)

Markets

There are few cheap sectors, gold miners may be one of them. (Morningstar)

Muni bonds and volatility are words rarely spoken together. (Income Investing)

A seasonality alert: November is nigh. (Jeff Hirsch)

The most important charts in the world. (Business Insider)

Strategy

There are few easy answers for bond investors at present. (A Wealth of Common Sense)

Being a contrarian is a lonely business. (Millennial Invest)

Can a four-year old do what Carl Icahn does? (Justin Fox)

Books

A nice review for Gary Antonacci’s Dual Momentum Investing: An Innovative Strategy for Higher Returns with Lower Risk. (Reading the Markets)

Larry Cunningham’s Berkshire Beyond Buffett: The Enduring Value of Values is a good read. (Aleph Blog)

Companies

Amazon ($AMZN) has undeperformed IBM ($IBM) over the past year. (SL Advisors)

IBM just inked a data-related partnership with Twitter ($TWTR). (Business Insider)

Finance

Why CEOs love share buybacks. (WSJ)

How some traders get info from the SEC faster than others. (WSJ)

Robo-advisors

Charles Schwab ($SCHW) is launching its own robo-advisor. (ETF)

While Wealthfront adds to its capital coffers. (TechCrunch, Pando Daily, Wealthfront)

Personal Capital has also added more capital. (TechCrunch)

Why bother at all with robo-advisors? (FT)

Global

What the magazine cover indicator is saying about Europe now. (Barry Ritholtz)

Does stock picking work in emerging markets? (Alliance Bernstein)

Is Norway’s sovereign wealth fund doing it wrong? (Finanskrobat)

Economy

Don’t expect any surprises from the FOMC this afternoon? (Tim Duy)

Are student loan balances the reason behind more adults living with their parents? (Real Time Economics)

Earlier on Abnormal Returns

Building your personal margin of safety. (Abnormal Returns)

Q&A with Wes Gray of Alpha Architect and the ValueShares US Quantitative Value ETF ($QVAL). (Abnormal Returns, part 2)

What you might have missed in our Sunday linkfest. (Abnormal Returns)

Mixed media

Your future Twitter experience is likely going to be filtered by an algorithm. (GigaOM)

What is going on with Amazon’s devices, like the Fire TV stick? (Farhad Manjoo)

How much do Uber drivers really make? (Slate)

You can support Abnormal Returns by visiting Amazon or follow us on StockTwits, Yahoo Finance and Twitter.