Quote of the day

Mark Buchanan, “As trading moves to inhumanely short timescales, we shouldn’t be surprised, but should actually expect to see increasingly frequent Black Swan events in microscopic timescales. They may well be the natural consequence of machine trading that is becoming uncoupled from the strong influence of conscious human decision making.” (Bloomberg)

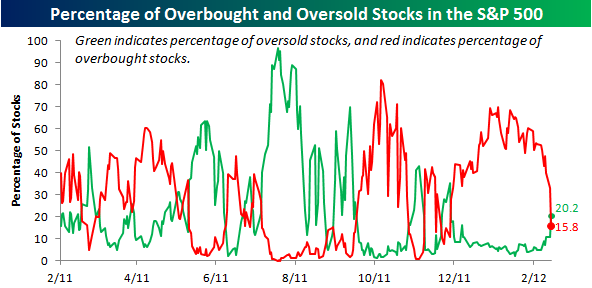

Chart of the day

Neat visualization of the fact that the market is no longer overbought. (Bespoke)

Markets

What happens if financials finally break out? (All Star Charts)

Rob Arnott is worried about negative US demographics affecting stocks. (WSJ)

It’s been a good year for everyone long Venezuela/short Bangladesh. (Bespoke)

Strategy

Blindly following someone else’s trades in real-time is a recipe for disaster. (Joe Fahmy)

The 60/40 portfolio is riskier than you think. (World Beta)

Do low volatility techniques matter? (Falkenblog)

The best strategies are often the most simple. (Old School Value)

Not every anomaly requires hyperkinetic trading. (Capital Spectator)

Do investors care if an analyst has a position in a stock he/she recommends? (SSRN)

Companies

Don’t count Apple’s ($AAPL) well-patented iWallet of the payment race. (9to5Mac)

One casualty of lower natural gas prices: big buyout Energy Future Holdings. (FT)

Does the cash conversion cycle for the big retailers? (YCharts Blog)

Finance

Why TRS ponied up to buy a stake in Bridgewater Associates. (Dealbook)

Eddie Lampert is having a good 2012. (Term Sheet)

Extra cash need not turn into additional lending. (FT Alphaville)

“Complexity is often useful, but complexity for its own sake is needlessly dangerous.” (Free exchange)

ETFs

Happy anniversary, I bought you an ETF. (Ari Weinberg)

The many problems with a physically backed diamond ETF. (Kid Dynamite)

Some commodity ETPs are locked into front month contracts. (IndexUniverse)

Hedge funds don’t want their investors to know they use ETFs extensively. (Pensions & Investments)

With money market funds on the ropes, ETF providers are rolling out actively managed ultra-short bond fund ETFs. (IndexUniverse)

Oil

Stephen King, “Oil is the new Greece.” (FT)

Who is going to be the big oil importer in 2035? (FT Alphaville)

The global energy business is not for the faint of heart or undercapitalized. (Deal Journal)

Economy

Future Fed bond purchases will be “sterilized”, got it peeps? (WSJ, FT Alphaville, MarketBeat)

The February ADP report shows continued jobs growth. (Calculated Risk, Capital Spectator)

An estimate for Friday’s NFP report. (Crossing Wall Street)

Unit labor costs are on the rise. (Pragmatic Capitalism)

If the “sand states” can improve that implies good things for the US labor economy. (Money Game)

Some initial signs of a turn in the US housing market. (FT Alphaville)

Earlier on Abnormal Returns

Trading to improve your portfolio is a worthy principle upon which to build a portfolio strategy. (Abnormal Returns)

The Abnormal Returns book cover is live. (Abnormal Returns)

What you missed in our Wednesday morning linkfest. (Abnormal Returns)

Mixed media

Investing in startups based on pattern recognition is not enough. (Chris Dixon)

Car sharing is shaping up as the next big peer-to-peer business. (Slate)

The rise of the amateur has disrupted all forms of content. (GigaOM)

Space is closer than you think. (kottke)

Abnormal Returns is a founding member of the StockTwits Blog Network.