You can keep up with all of our posts by signing up for our daily e-mail. Thousands of other readers already have. Don’t miss out!

Quote of the day

Eric D. Nelson, “Enlightened investors know that not all investment risks are worth taking.” (Servo Wealth)

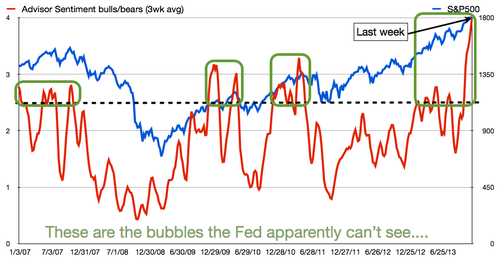

Chart of the day

Advisors are wicked bullish. (Greedometer via @ppearlman)

Markets

Three bearish charts. (Pragmatic Capitalism)

2013 has been a pain-free year for equity investors. (Big Picture)

Jeff Gundlach is in no hurry to buy mortgage REITs. (Income Investing

Strategy alert: shift away from the consumer toward industry. (The Reformed Broker)

Internet stocks are breaking out. (Bespoke)

Strategy

The folly of forecasting, part 238. (Above the Market, Barry Ritholtz)

Why Warren Buffett’s bet against hedge funds is working out. (Rekenthaler Report)

Ten things you need to know before starting your trading day. (ZorTrades)

Lessons we should have learned from the Madoff debacle. (WashingtonPost)

Companies

Why Twitter ($TWTR) stock is back at new highs. (Breakout, Estimize)

Icahn Enterprises ($IEP) looks to be “grossly overvalued.” (Barron’s)

Finance

How should we view record corporate borrowing in the QE age? (FT)

The number of banks in America are in secular decline. (Businessweek)

JP Morgan ($JPM) has filed a patent on a Bitcoin-style payment system. (FT)

A Volcker Rule explainer. (The Guardian)

Can value investors justify buying Bitcoins? (Aaron Brown)

Funds

You can thank Bernie Madoff for the rise in liquid alternative funds. (Jason Zweig)

Hedge funds are out of the business of generating alpha. (FT)

Why the WisdomTree Japan Hedged Equity Fund ($DXJ) worked and why other currency-hedged funds may not. (IndexUniverse)

Economy

Five reasons for economic optimism in 2014. (Calculated Risk)

The Fed has a lot of options beyond “the taper.” (FT Alphaville also Business Insider)

Business cycle risk remains low. (Capital Spectator)

By this measure poverty is America has been falling for decades. (New Yorker)

Earlier on Abnormal Returns

The details on the “small act of kindness” Abnormal Returns holiday book giveaway. (Abnormal Returns)

What you may have missed in our Tuesday linkfest. (Abnormal Returns)

Mixed media

A good list of 15 financial sites and apps. (CNNMoney)

BillGuard is the “fairy godmother” of finance apps. (Mineral Tree)

Some resources for the beginning investor. (Zone of Competence)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.