Quote of the day

David Merkel, “Personally I don’t think that retail investors are abnormally disappointed at present. This is just market noise — we face overvaluation, but positive momentum.” (Aleph Blog)

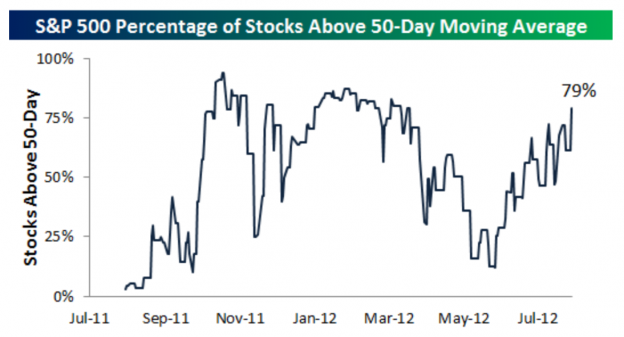

Chart of the day

Check out the turnaround in the S&P 500. (Bespoke)

Equities

Newsletter writers are getting pretty bullish. (Mark Hulbert)

A sign that risk appetites are back. (Tyler’s Trading)

Why is the equity market rallying despite a muted economy? (Calafia Beach Pundit)

Markets

The technical case for higher Treasury yields. (All Star Charts)

Why are commodity correlations on the rise. (IndexUniverse)

Europe’s stock markets are perking up. (I Heart Wall Street)

Companies

Are higher corporate cash balances here to stay? (FT Alphaville)

LinkedIn ($LNKD) vs. Facebook ($FB): a tale of the tape. (Time)

How the Square-Starbucks ($SBUX) relationship will work. (SplatF)

Is Priceline ($PCLN) still overvalued? (Crossing Wall Street)

Media

Americans really are beginning to cut the cord on pay TV. (WSJ)

What kinds of content eventually attracts a deep-pocketed suitor? (Pando Daily)

The New York Times ($NYT) is saying goodbye to About.com. (AllThingsD)

John Malone and Liberty Media ($LMCA) is kicking Starz to the curb. (Deal Journal)

Finance

UK banks are in a heap of trouble. (WSJ, FT Alphaville)

How long will it take Fannie Mae to pay back the Treasury? (Money Game)

Time to bring back Build America Bonds. (Bloomberg)

Meredith Whitney said what? (Clusterstock)

ETFs

What’s the best minimum volatility ETF? (IndexUniverse)

This ETF game is tougher than it looks. (Focus on Funds, InvestmentNews)

No one really knows the price of diamonds. It looks like that vacuum may get filled. (Total Return)

Global

What should we make of shifts in peripheral Euro yield curves. (Pragmatic Capitalism)

The big problems facing the global economy. (Bonddad Blog)

Economy

US consumer credit pulled back in July. (FT Alphaville)

A look at the baseline economic scenario for the US economy. (Tim Duy)

Four risks that could derail the US economy. (Real Time Economics)

How an ‘export shock‘ might affect the domestic economy. (Money Game)

The Fed

How the Fed could specifically target lower mortgage rates. (Economic Musings)

A look at those American who have paid a price for a zero interest rate policy. (Sober Look)

Earlier on Abnormal Returns

What you missed in our Wednesday morning linkfest. (Abnormal Returns)

Mixed media

Are you an aspiring hedge fund manager? Here’s a way to choose a name for your fund. (Hedge Fund Name Generator)

What are the top five trading movies? (Brian Lund)

Abnormal Returns is a founding member of the StockTwits Blog Network.