You can keep up with all of our posts by signing up for our daily e-mail. Thousands of other readers already have. Don’t miss out!

Quote of the day

Salil Mehta, “In order for price-to-earnings (P/E) ratios to be useful for long-term asset allocators, they should be somewhat more stable and stationary over time. This allows one to make and act on a decision, without the ratio confusingly oscillating about, too much, in-between.” (Statistical Ideas)

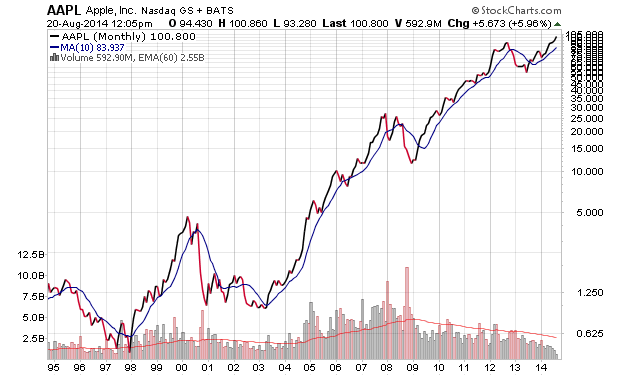

Chart of the day

Apple ($AAPL) is back at all-time highs. Has sentiment gotten ahead the stock price? (Dan Nathan)

Markets

The US Dollar Index is breaking out. (Dragonfly Capital, Humble Student)

It is not unusual for the stock market to be at all-time highs. (A Wealth of Common Sense)

In praise of a jump in volatility. (Rick Ferri)

Stocks don’t have to be in a bubble to have a significant decline. (Pension Partners)

Americans have no idea what is happening in the stock market. (The Reformed Broker)

Finance

William Lazonick, “The buyback wave has gotten so big, in fact, that even shareholders—the presumed beneficiaries of all this corporate largesse—are getting worried.” (HBR)

ETFs

Twelve lessons learned about fund investing. (Brendan Conway)

Global

Norway’s sovereign wealth fund is loading up on global real estate. (MoneyBeat, Bloomberg)

Emerging markets have had a pretty good year so far. (Dr. Ed’s Blog also beyondbrics)

Economy

The rising economy is enticing those out of the labor force to come back. (Reuters)

Earlier on Abnormal Returns

What you might have missed in our Tuesday linkfest. (Abnormal Returns)

Mixed media

Twitter ($TWTR) is cluttering up your timeline. (TechCrunch, Business Insider)

Why do online retailers feel the need to have a physical outpost? (Washington Post)

How social media is being mined to close down dirty restaurants. (Scientific American)

You can support Abnormal Returns by visiting Amazon or follow us on StockTwits, Tumbler and Twitter.