Quote of the day

Howard Lindzon, “You stay in the game long enough so you can keep swinging and sometimes magic happens.” (Howard Lindzon)

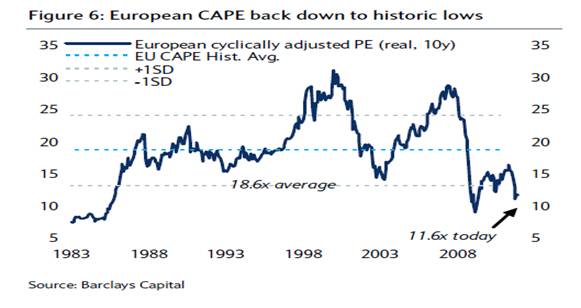

Chart of the day

European equities are historically cheap. Likely with good reason. (Street of Walls via ValueWalk)

Markets

Why the Santa Claus rally may be a real thing. (Marketwatch)

30-year mortgage rates are now firmly below 4%. (Bespoke)

Strategy

How to trade “lunatic market moves.” (Phil Pearlman)

Talking options strategies with Jared Woodard. (Expiring Monthly)

Companies

Questioning the durability of Google’s ($GOOG) economic moat. (Turnkey Analyst)

David Einhorn is not backing off of his Green Mountain Coffee ($GMCR) short. (Reuters)

“It’s hard to see a happy ending” at Research in Motion ($RIMM). (SplatF)

How the iPhone changed the balance between carriers and handset makers. (WSJ)

Finance

Michael Kors ($KORS) is a perfect example of our increasingly globalized corporate world. (Dealbook)

Apparently the business of America is tax-shifting. How the Cayman Islands became the new Puerto Rico. (Bloomberg)

Funds

Tough times for trend-following managed futures managers. (Attain Capital)

ProShares is planning to launch a new kind of volatility ETF. One that uses a 15% volatility target. (IndexUniverse)

Which ETF gives the “purest exposure” to the renminbi? (IndexUniverse)

Global

More on the ECB’s big LTRO. (WSJ, Bloomberg, Kid Dynamite, Money Game, MarketBeat)

European banks are selling everything they can including US mortgage backed securities. (FT)

Economy

The Fed’s post-crisis policies may be entering a new phase. (Econbrowser)

Putting today’s economic turmoil into historical perspective. (Pragmatic Capitalism)

An in-depth look at Tyler Cowen’s The Great Stagnation. (FT)

The coming renaissance in American manufacturing. (The Atlantic, Bonddad Blog)

History matters far more than we think in economics. (Stumbling and Mumbling via Economist’s View)

Real estate

A sign of the times. Apartments are the new malls. (WSJ)

Housing analysis: bull vs. bear. (Calculated Risk)

Some perspective on housing starts. (EconomPic Data, Real Time Economics)

Earlier on Abnormal Returns

What you missed in our Wednesday morning linkfest. (Abnormal Returns)

Mixed media

Sometimes the best trade is no trade at all. (Dinosaur Trader)

Crony capitalism and the college bowl system. (Grantland)

Likely the best gift you can give this season. (Marketwatch)

Abnormal Returns is a founding member of the StockTwits Blog Network.