You can keep up with all of our posts by signing up for our daily e-mail. Thousands of other readers already have. Don’t miss out!

Quote of the day

Cullen Roche, “Past data can give you a general idea of what might occur in the future (assuming you have a decent grasp of the underlying drivers of the future potential returns), but we have to account for the stochastic component of any market.” (Pragmatic Capitalism)

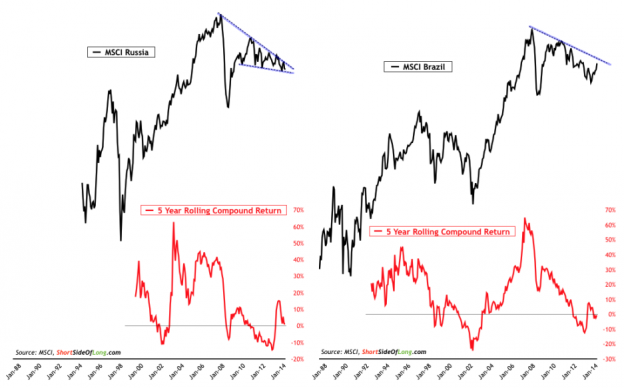

Chart of the day

The Russian and Brazilian stock markets haven’t done anything the past five years. (The Short Side of Long)

Markets

A major bear has capitulated. Time to worry? (Big Picture)

Where did all the 52-week highs go? (Dana Lyons)

Don’t underestimate the anxiety that a bull market can engender. (A Wealth of Common Sense)

The top 10 buys and sells from the ultimate stock pickers. (Morningstar)

Mom and pop are pouring money into stocks instead of bonds. (Barry Ritholtz)

Why investors need to adjust their expectations. (Servo Wealth)

Fees

Why do we think higher fees will generate higher net returns? (Bucks Blog)

Higher fees are attracting competition for smart beta ETFs. (FT)

Strategy

The strategic case for TIPS. (Vanguard Blog)

Are low vol funds getting crowded? (FT)

The mystery of momentum explored. (Larry Swedroe)

Books

A review of Tobias Carlisle’s Deep Value: Why Activist Investors and Other Contrarians Battle for Control of Losing Corporations. (Aleph Blog)

A look at Timothy Knight’s Panic, Prosperity and Progress: Five Centuries of History and the Markets. (Enterprising Investor)

Companies

Apple ($AAPL) is having to deal with security issues as the launch of the new iPhone nears. (Business Insider)

Finance

The IEX Group just raised more venture capital and is becoming an exchange. (WSJ, Dealbook)

Funds

The pendulum has swung too far toward indexing. (The Felder Report)

You have to look below the headlines to find signal in ETF fund flow data. (Matt Hougan)

Strategic beta ETFs skew toward higher Morningstar ratings. (Morningstar)

Economy

There is a reason why Treasury yields have been low for long. (Econbrowser)

Manufacturing is booming. Why aren’t yields moving higher? (Calafia Beach Pundit)

What role does demographics play in the secular bull market for bonds? (Dr. Ed’s Blog)

Earlier on Abnormal Returns

What books Abnormal Returns readers purchased in August. (Abnormal Returns)

What you might have missed in our Monday linkfest. (Abnormal Returns)

Mixed media

Now angel investors can get access to pre-IPO rounds. (Forbes)

The threat to seed investors. (peHUB)

Daily fantasy sports is becoming a big business. (Dealbook)

You can support Abnormal Returns by visiting Amazon or follow us on StockTwits, Tumblr and Twitter.