You can keep up with all of our posts by signing up for our daily e-mail. Thousands of other readers already have. Don’t miss out!

Quote of the day

Phil Pearlman, “So we had these two gigantic bubbles and we were all affected and the culture was affected and yet we don’t really acknowledge how affected we were and how the remnants of those events shade our interpretations of present experiences.” (Phil Pearlman)

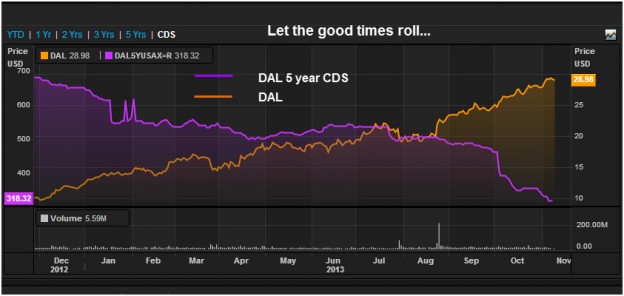

Chart of the day

Delta Air Lines ($DAL) looks like a new company. (AlphaNow)

Markets

European markets are rolling over. (The Short Side of Long)

2014 stock performance will have nothing to do with 2013. (Mark Hulbert)

Investment managers are leveraged long. (All Star Charts)

Seven reasons from Doug Kass why the market is overvalued. (Pragmatic Capitalism, TheStreet)

REITs now look relatively attractive. (Morningstar)

Strategy

AMR Corp. will be one of the few bankruptcies in which equity holders come out ahead. (WSJ)

Why wirehouse advisers should become RIAs. (InvestmentNews)

Technology

The semantic search business is not a one-horse race. (Business Insider)

Why your phone may soon see in 3D. (TechCrunch)

Investors are moving beyond Twitter ($TWTR) to find social startups. (Bloomberg)

IPOs

On the seasonality of IPOs. (Reuters)

Hong Kong is experiencing a mini-IPO boom. (FT)

Some companies that could go public in 2014. (Hunter Walk)

Companies

Should AT&T ($T) buy Vodafone ($VOD)? (FT)

How Hess Corp. ($HES) has shrunk itself to success. (Term Sheet)

How Intuit ($INTU) left $600 million on the table. (Term Sheet)

Finance

A look at the world’s first hedge fund ad. (Focus on Funds, Buzzfeed)

There is a bull market in firms offering managed ETF strategies. (Reuters)

Remember credit derivatives? Clearing and collateral issue still remain. (Felix Salmon)

Funds

How to invest in muni bonds: low cost and broad diversification. (Vanguard Blog)

Slicing the dicing the market taken to its illogical extremes. (Vanguard Blog via Focus on Funds)

Gold miners are falling but the ETFs are gaining assets. (IndexUniverse)

Economy

New home sales surged in October. (Calculated Risk, Bloomberg)

Why the ISM manufacturing data is running ahead of the “hard data.” (FT Alphaville)

While the non-manufacturing data for November showed some erosion. (Calculated Risk)

Americans are borrowing to buy new cars. (Quartz also Dr. Ed’s Blog)

An honest debate about the value of raising the minimum wage. (FT Alphaville)

Earlier on Abnormal Returns

What you may have missed in our Tuesday linkfest. (Abnormal Returns)

Mixed media

On the difference between a breakthrough innovation and a product upgrade. (WSJ)

The failed promise of 23andMe. (Bloomberg)

SpaceX successfully puts its first commercial payload into orbit. (Space, LATimes)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.