You can keep up with all of our posts by signing up for our daily e-mail. Thousands of other readers already have. Don’t miss out!

Quote of the day

David Fabian, “Holding a slug of cash in your portfolio is not a bad thing as long as you are disciplined enough to put it to work when opportunities arise. It should be looked at as a short-term hiding spot and not a long-term investment theme.” (Minyanville)

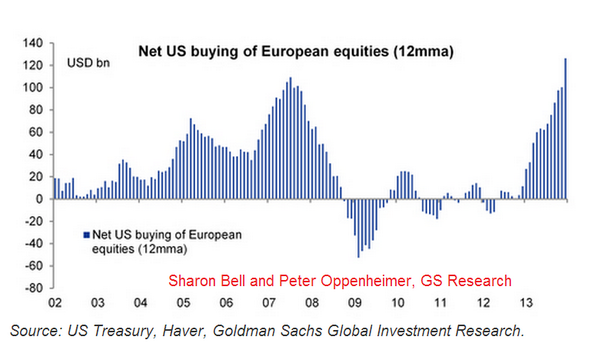

Chart of the day

Investors can’t get enough European equities. (@gavyndavies)

Commodities

Managers are still skeptical of commodities. (The Short Side of Long)

The case for silver. (Market Anthropology)

Gold pessimism has evaporated. (Focus on Funds)

Check out the reversal in the crude oil/natural gas ratio. (All Star Charts also Focus on Funds)

Markets

Why the big bounceback in munis? (FT)

A look at some global market caps. (Bespoke)

Are biotechs really overblown? (Humble Student)

Ten high conviction picks from the “ultimate stock pickers.” (Morningstar)

Strategy

Why you should view drawdowns as information. (TraderFeed)

Six lessons on systems trading. (SMB Training)

Controlling costs is secondary to controlling your emotions. (Aleph Blog)

60/40 works, but even more diversification works better. (A Wealth of Common Sense)

A nice review of Simon Lack’s Bonds Are Not Forever: The Crisis Facing Fixed Income Investors. (CFA Institute)

Research

The active management industry has become more skilled over time. (SSRN)

Is the Russell 2000 index gameable? (Turnkey Analyst)

Putting the Ivy Portfolio through its paces. (GestaltU via Meb Faber)

Companies

Can King Digital, the makers of Candy Crush, come up with another mega hit? (Businessweek, Recode, Time)

The case against Tesla ($TSLA) stock. (MoneyBeat)

Finance

David Einhorn wants to unmask an anonymous Seeking Alpha blogger. (Dealbook)

Investors are losing patience with trend following hedge funds. (Bloomberg)

Where’s the outrage over Eric Schmidt’s huge pay package? (Dealbook)

Wall Street

Banks still haven’t changed much for their first-year analysts. (CNBC)

Three reasons why Wall Street analysts are miserable, an excerpt from Kevin Roose’s Young Money: Inside the Hidden World of Wall Street’s Post-Crash Recruits. . (The Atlantic)

Global

Europe is awash in IPOs. (FT)

Emerging markets have had a miserable three years. (WSJ also Charts etc.)

Why emerging markets matter. (Fortune)

Economy

The effect of the polar vortex on the housing market. (Business Insider, Calculated Risk)

Three reasons the economy isn’t doomed. (WashingtonPost)

Earlier on Abnormal Returns

What you may have missed in our Tuesday linkfest. (Abnormal Returns)

Mixed media

Matthew Yglesias, “What Netflix doesn’t yet have is the depth of experience in creating really great shows. But in business, there is more to life than quality. Cost, convenience, and flexibility matter, and Netflix wins on all of those.” (Slate)

Why cable companies are so scared of Netflix ($NFLX). (Wired)

You may not know it but your Netflix streaming is getting throttled. (Time, Breakout)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.