Joanna Chung at the Financial Times reports on the increasingly weak relationship between emerging market bond and high yield bond returns. Historically the return on both of these risky asset classes have been somewhat correlated. Recently, however the

relationship seems to have disappeared.

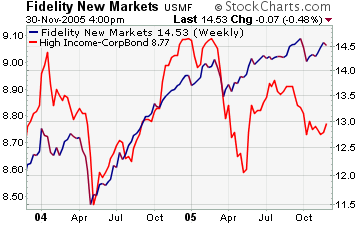

One can get some sense for the two asset classes by comparing the prices of two Fidelity mutual funds: New Markets Income (emerging markets) and High Income (high yield). Emerging markets have clearly outperformed, but there is still some relationship between the two. The challenge is disentangling the effects of overall interest rates and spreads.

Although previous research has shown that the link was always variable, there was a tendency for spreads to move together during times of stress. This is not however an economic link, rather one related to a common investor base.

âThey are fundamentally different asset classes with totally different underlying dynamics,â? says Jerome Booth, head of research at Ashmore Investment Management, an emerging markets specialist. âThe relationship between high yield and emerging markets is one of investor behaviour, not underlying direct causality.â?

When emerging market bonds became investable, some of the earliest investors in emerging market bonds, i.e Brady bonds, were high yield investors. Over time, the development of asset pools dedicated to emerging market bonds and the decreasing credit risk of emerging market bonds in general have both lead to a de-linking of the two asset classes.

Only time will tell if the spread relationship between the two has been irreparably severed. One acid test may tell the tale,

.. an unexpected market event could offer the ultimate test of the relationship between emerging market and high-yield bonds. âCorrelation can be observable in the past,â? says Mr Booth of Ashmore. âBut if there is a big shock, that relationship is almost certain to disappear.â?