Quote of the day

Tom Brakke, “If you choose to pursue an MBA or a CFA, remember that they are built upon orthodoxy, by and large, which you need to learn and attack at the same time.” (the research puzzle)

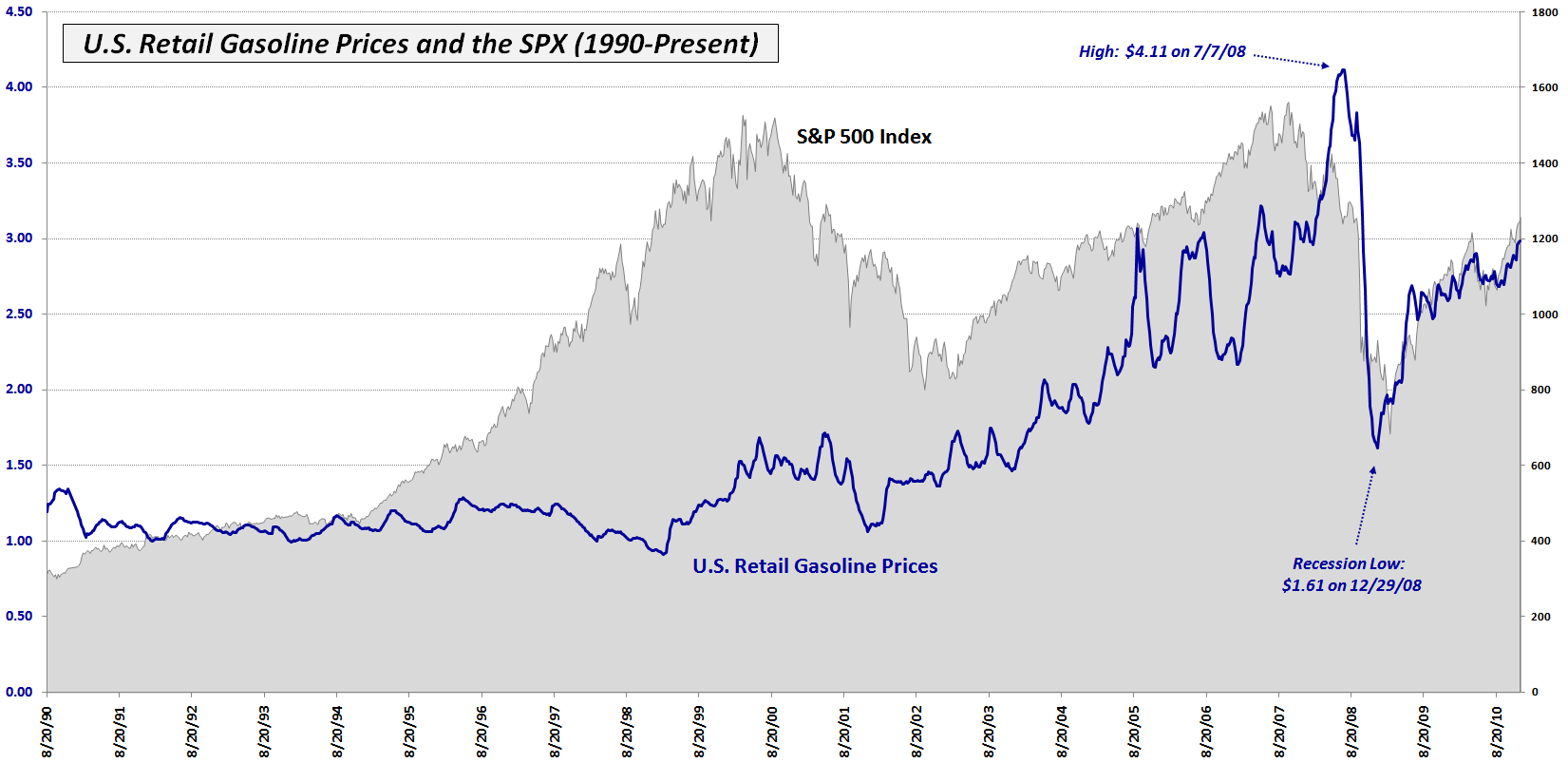

Chart of the day

Don’t look now but gasoline prices are creeping back up. (VIX and More also Infectious Greed)

Markets

The week between Christmas and New Year’s has historically been bullish. (Bespoke)

Why Australian equities are an “obvious short” in 2011. (Jack H Barnes)

Eight things the stock market should be worried about. (DailyFinance)

Everybody is overweight emerging markets. (beyondbrics)

Patrick Burns, “Random walks are on a tightrope between mean reversion and momentum.” (Portfolio Probe)

Strategy and Tactics

Ken Griffin looks back on the twentieth anniversary of Citadel. (Dealbook also Chicago Breaking Business)

A quick education in spread trading. (Bigger Capital)

Measures of sentiment and valuation are decidedly imperfect. Indeed they don’t matter much in a bull market, until they matter. (AR Screencast)

How do you bring illiquidity into intrinsic valuation? (Aswath Damodaran)

Predictions are for entertainment, not investing. (Minyanville)

A positive review for the Little Book of Sideways Markets by Vitaliy Katsenelson. (zentrader via Money Game)

Companies

McDonald’s (MCD) is pushing variety in an attempt to continue its growth. (WSJ)

The smartphone explosion. (A VC, Howard Lindzon, Asymco, SAI)

Finance

Private equity has some IPOs it wants to sell you in 2011. (WSJ)

Goldman Sachs (GS) makes its change in compensation focus official. (footnoted)

How much is Sarbox to blame for the boom in start-up valuations? (GigaOM)

Why Chapter 11 cases are shrinking. (Dealbook)

Media

On the potential for feedback loops for users of textual analysis. (Atlantic Business)

How the media skews our view of reality. (Big Picture)

In the world of social media what you give comes back in droves. (The Minimalist Trader)

Economy

The Fed is going to look a lot different in 2011. (NYTimes)

The bond market sees an improving economy. (Econbrowser)

The “raise rates now” camp garners another adherent. (The Reformed Broker)

Job offers are on the rise. (Big Picture)

On the prospect for inflation. (Points and Figures)

Global

Japan’s budget is a mess. (WSJ, Money Game also Huffington Post)

Why don’t Chinese consumers spend more? (Curious Capitalist)

Vietnam’s prior push for growth is coming back to haunt it. (WSJ)

Listomania

Doug Kass’ full list of surprises for 2011. (Infectious Greed, Money Game)

The top 10 finance feuds of 2010. (The Reformed Broker)

The ten best new ETF launches of 2010. (ETFdb)

The top 10 hedge funds stories of 2010. (AR+Alpha via World Beta)

Thanks for checking in with Abnormal Returns. For all the latest you can follow us on StockTwits and Twitter.