Quote of the day

Alen Mattich, “When you buy commodities, you’re shorting human ingenuity.” (The Source)

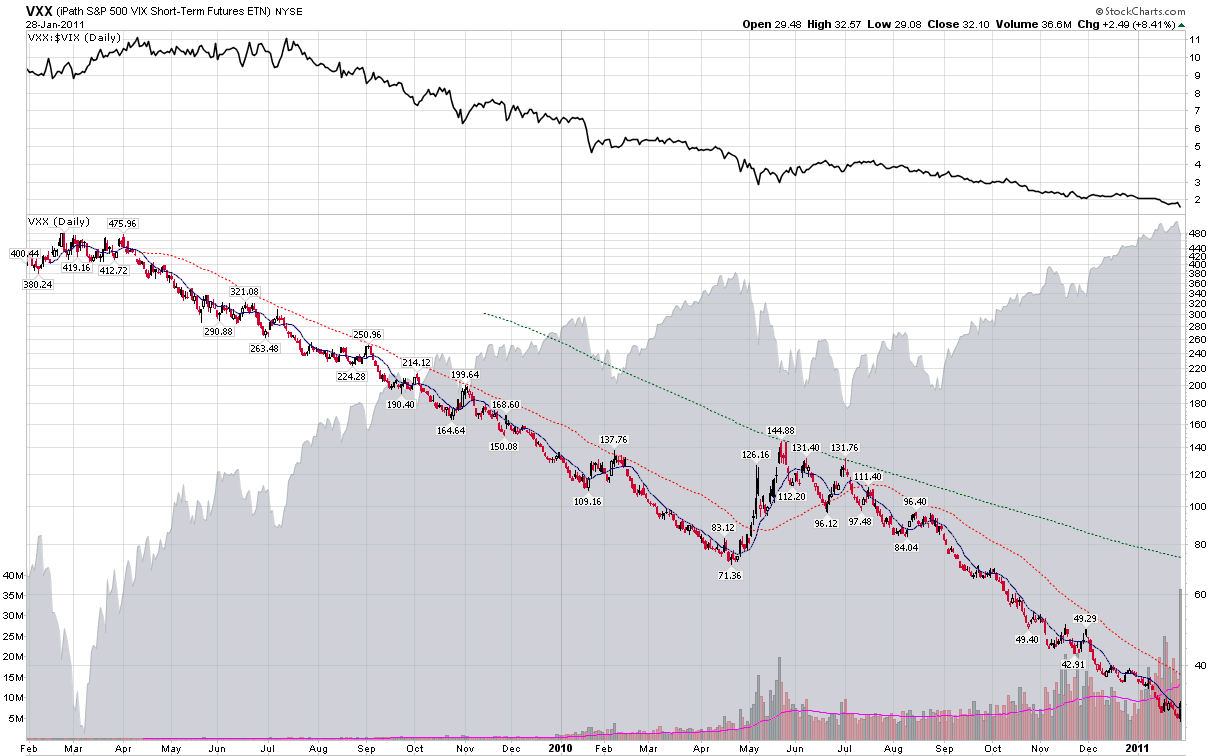

Chart of the day

One ugly chart: two years of the iPath S&P 500 VIX Short-Term Futures ETN (VXX). (VIX and More)

Markets

How much does Egypt matter if the stock market is up today? (Mean Street)

Frontier market hype aside, the Middle East is still not investable. (Herb Greenberg)

Creation of Market Vectors Egypt Index ETF (EGPT) shares are halted. (IndexUniverse)

The Suez is not why oil is at $100 a barrel. (FT Alphaville)

Strategy

Who cares what the stock market did today? (Bucks Blog)

Kathleen Gaffney and Martin Fridson talk bond strategy with Consuela Mack. (Wealthtrack)

Companies

Ship owners (and builders) didn’t learn the lessons of the credit crisis. (The Source)

The risks surrounding Demand Media (DMD). (The Reformed Broker)

Erick Schonfeld, “A digital magazine or newspaper should feel like a media app, not like a PDF viewer.” (TechCrunch)

Finance

The 2015 banking crisis foretold. (FT Alphaville, Bloomberg)

Abby Joseph Cohen in the hot seat. (Dealbreaker)

Economy

The Chicago PMI came in hot. (Bloomberg, Bespoke)

Help wanted ads surge. (ValuePlays)

Is the rise in the personal savings rate over? (Calculated Risk)

Tyler Cowen on our economic plateau and what we can do to get off of it. (Real Time Economics, Ezra Klein)

A self-sustaining economic recovery is still dependent on an external re-balancing. (Economist’s View)

A decade of gains in home ownership are gone. Where will the rate bottom? (Calculated Risk)

Also on Abnormal Returns

Good times for Exxon Mobil (XOM) means tougher times ahead for the consumer. (AR Screencast)

Our Monday morning link look-in. (Abnormal Returns)

Errata

Eat fish (oil). (Scientific American)

Eight alternatives to college. (Altucher Confidential)

Thanks for checking in with Abnormal Returns. For all the latest you can follow us on StockTwits and Twitter.