Quote of the day

Barry Ritholtz, “When you are in the polling booth, vote however you like; But when you are reviewing your investing options, it is best to do so with a cold, dispassionate eye.” (WashingtonPost)

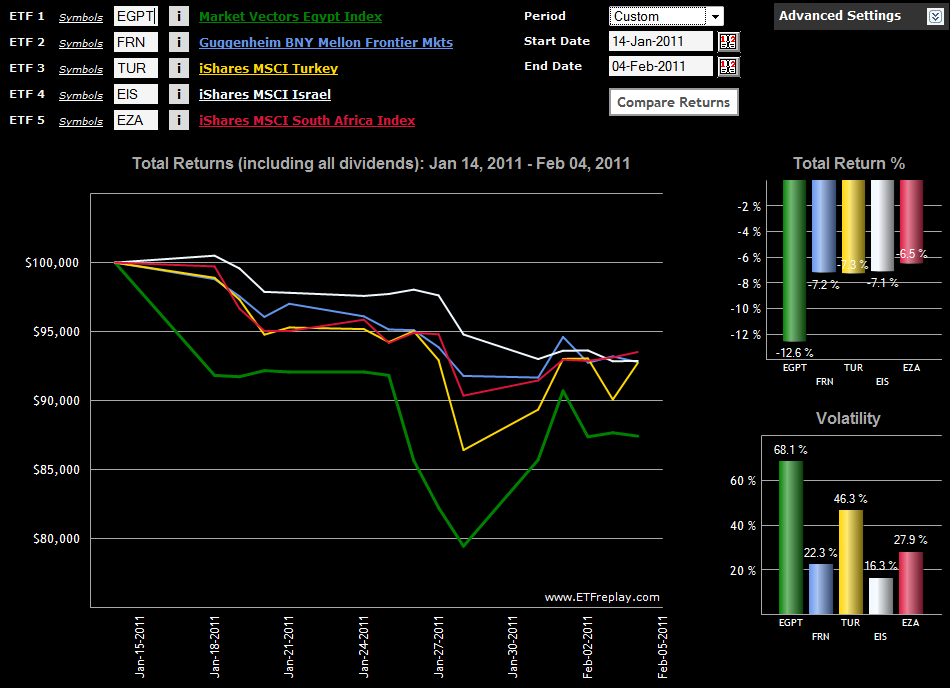

Chart of the day

The damage Egypt hath wrought on the frontier markets. (VIX and More)

Markets

Investment grade bond yield spreads are back to August 2007 levels. (WSJ)

Are higher bond yields a sign of brewing inflationary expectations? (WSJ also Street Sweep)

Can we trust the signals we get from TIPS? (Free exchange)

Little sign of a decline in demand for precious metals. (Bloomberg)

Strategy

Sean McLaughlin, “If you don’t know your edge, then you don’t have one. ” (The Minimalist Trader)

You have to lose money to make money. (Downtowntrader)

The three “secrets” of equity investing. (The Source)

ETFs

Competition in the ETF ratings space. (InvestmentNews)

There are 152 funds on the ETF deathwatch for February. (Invest With An Edge)

Are emerging market ETFs at greater risk of liquidation in a crisis? (beyondbrics)

Companies

Bruce Berkowitz wants to become much more involved in running St. Joe Company (JOE). (Fortune Finance, ValuePlays)

A Groupon for stocks? (The Reformed Broker)

How is the Nasdaq hack going to affect its ability to attract new business? (SAI)

Another buyer of small biotechs steps up. (The Source)

Can Nokia (NOK) ever recover from its strategic failings? (24/7 Wall St.)

HuffPo+AOL

Looking at the Huffington Post purchase as a ‘Hail Mary’ pass. (Ken Auletta, SAI, Dealbook)

Make no mistake Huffington Post is taking over AOL (AOL). (Deal Journal, Felix Salmon)

More online consolidation is coming. (Credit Writedowns)

Economy

Tim Duy, “The output gap remains strikingly large for an economy in expansion since the middle of 2009.” (Economist’s View)

Ben Bernanke is not fooled by higher food prices. (Money Game)

In the Federal budget we need to do a mix shift from consumption to investment. (New Yorker)

State governments plan further budget cuts. (WSJ)

Just what job seekers need, more licensing requirements. (WSJ, Modeled Behavior, Marginal Revolution)

Are speculators to blame for higher food prices? (The Source)

Earlier on Abnormal Returns

The economy has surprised observers ever since the beginning of the rally back in September. (AR Screencast)

Our Monday morning live link look-in. (Abnormal Returns)

Mixed media

Do Q&A sites answer questions worth asking? (Michael Mandel)

The best finance/investing podcasts on iTunes. (Tradestreaming)

A first hand account of financial book publishing and why it has changed forever. (Altucher Confidential)

Thanks for checking in with Abnormal Returns. For all the latest you can follow us on StockTwits and Twitter.