Quote of the day

Yves Smith, “McKinsey is in the business of propping up diseased managements.” (naked capitalism)

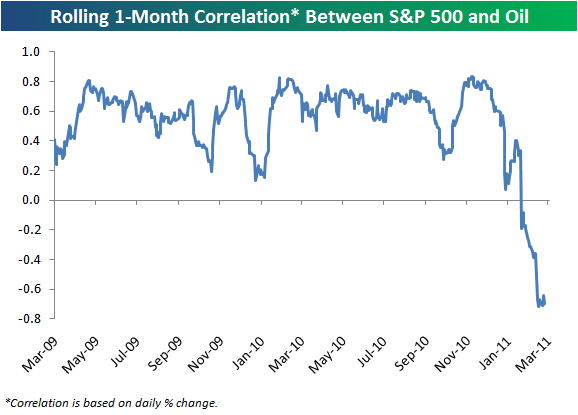

Chart of the day

Oil and the S&P 500 have started to go their separate ways. (Bespoke)

Markets

Equity sentiment at week-end. (Trader’s Narrative)

Does the new CBOE SKEW index tell us something we don’t already know? (Zecco Pulse)

The case for US equities…from Canada. (Globe and Mail)

Taxable investors have seen some quick returns by fishing in muni waters. (NYTimes)

Pipelines for the win. (The Reformed Broker)

US Dollar

The US dollar and the strength in commodities. (StockCharts Blog)

The weaker US dollar is working…for now. (hedgefundinvest)

The US dollar is breaking down again. (StockCharts Blog)

Strategy

Most investors already own enough oil stocks, thank you very much. (WSJ)

Why investors should hope for a pick up in inflation. (NYTimes)

A $2 million lesson in the dangers of confirmation bias. (Stock Sage)

Piotroski on the value/glamour effect as a function of expectations errors. (SSRN via The Guru Investor)

Finance

The rise of the RIA. (InvestmentNews)

Inside the mind of an inside trader. (re: The Auditors)

On the proper interpretation of data from prediction markets. (Rajiv Sethi)

Social media

Facebook’s valuation continues to move up. (TechCrunch)

Valuations have to level off at some point. (Breakingviews)

Has LivingSocial found a way, in terms of offering national deals, to best Groupon? (WSJ)

Economy

How long will it take to reach full employment? (Economist’s View)

The great ‘reconfiguration‘ of capacity. (macrofugue)

American workers are not reaping the benefits of their productivity gains. (Real Time Economics)

On the “fiscal illusion” that has allowed us to run up trillion dollar deficits. (NYTimes, ibid)

The financialization of our economy has made it less stable. (Pragmatic Capitalism)

Earlier on Abnormal Returns

Top clicks this week on Abnormal Returns. (Abnormal Returns)

The power of connection in the investment world. (Abnormal Returns)

ARTV with David Merkel in which we talk Berkshire Hathaway (BRKB) and the dangers of reaching for yield. (Abnormal Returns)

Our Saturday long form linkfest. (Abnormal Returns)

Mixed media

Happy fourth blogiversary! (Aleph Blog)

Abnormal Returns is a founding member of the StockTwits Blog Network.