Quote of the day

Infinite Guest, “The global economic narrative now and for the next decade is one of tension between the West and developing nations, who share no common cultural heritage and whose economic interests do not align or are in direct conflict.” (Dealbreaker)

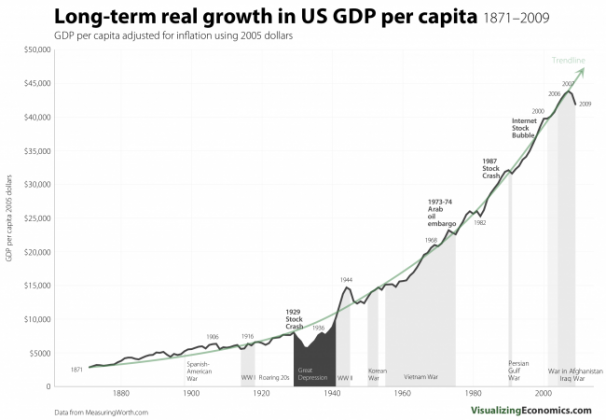

Chart of the day

A long term look at long-term real growth in US GDP per capita. (Visualizing Economics)

Bonds

Tough times out there in bondville. (The Reformed Broker, NetNet)

The search for yield has returned to the land of synthetics. (naked capitalism, FT Alphaville)

New muni bond issuance is at a virtual standstill. (WSJ)

Strategy

Why forecasting the business cycle can be a benefit to investors. (Calculated Risk)

James Montier’s seven immutable laws of investing. (Money Game, Zero Hedge, The Reformed Broker)

Reading THE book on best practices in equity analysis. (the research puzzle)

Technology

Motorola Mobility (MMI) as a pure play on Android. (SAI)

The fundamental mismatch between HP (HPQ) current product mix and what the market wants. (Bloomberg)

What iPad 2 should I get? (Marco, Apple 2.0, AppleInsider)

Companies are going to increasingly rely on ‘behavioral analytics.’ (The Atlantic)

Finance

Exchange mergers won’t change the balance from insurgent exchanges to the incumbents. (Fortune Finance)

Five start-ups mining the social web for investment signals. (IR Web Report)

The market really wants a bank foreclosure settlement. (naked capitalism, Big Picture)

Putting the SEC’s budget into perspective. (Big Picture)

Global

Wrapping your head around the case for Japanese equities. (FT Alphaville)

Why you shouldn’t expect a surge in Saudi Arabian oil production. (Econbrowser)

On the changing private value of oil in the ground. (Interfluidity)

Economy

Light truck sales are indicative of economic strength. (ValuePlays)

A dip in diesel fuel consumption in February. (Calculated Risk, Street Sweep)

Oil state budgets are benefiting from higher oil prices. (Bloomberg)

Sometimes a little delay goes a long way. (A Dash of Insight)

The recovery in employment has yet to hit California. (Gregor Macdonald)

Earlier on Abnormal Returns

The past years have been a crash course in market dynamics, hopefully we have learned its lessons. (AR Screencast)

Our Wednesday morning live link look-in. (Abnormal Returns)

Mixed media

Sleep deprivation can lead one to take undue risks. (Scientific American)

Be a blogger second. (Dan Shipper via TRB)

Abnormal Returns is a founding member of the StockTwits Blog Network.