Quote of the day

Michael Schuman, “So why do so many Americans think the U.S. doesn’t make anything anymore?” (Curious Capitalist)

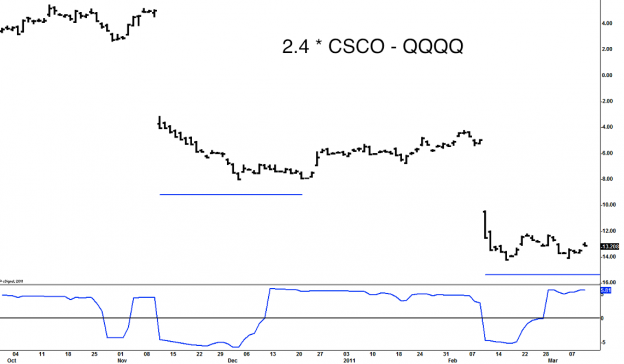

Chart of the day

Is Cisco (CSCO) finally done underperforming? (Dynamic Hedge)

Markets

Market breadth continues to weaken. (Data Diary, Bespoke)

The market tends to make fools out the most people possible. (The Minimalist Trader)

The pullback in oil. (MarketBeat)

Strange. The Charles Schwab (SCHW) “ETF Select List” includes a lot of Schwab ETFs. (WSJ, Random Roger)

Strategy

How should we read the Bill Gross position on Treasury bonds? (Pragmatic Capitalism, the research puzzle, Reuters)

Dinosaur Trader, “I no longer trade from an office. I trade from home. But with Skype and Stocktwits, it’s like I’m trading from the largest office in the world.” (The Reformed Broker, ibid)

On the difference between ‘talking your book‘ and ‘pumping your book.’ (Empirical Finance Blog)

Order execution and complex option trades. (Options for Rookies)

Companies

Another vote for CVS Caremark (CVS) as being undervalued. (YCharts Blog earlier AR Screencast)

iPad 2 launches. Motorola Mobility (MMI) down. (MarketBeat)

AIG (AIG) wants to buy back subprime mortgages from the Fed. Huh? (Kid Dynamite)

Finance

The IPO market is back, for now. (Term Sheet, CNBC)

The SEC can’t seem to get out of its own way. (Dealbook)

How much should companies pay directors? (Felix Salmon)

Regulators likely can’t prevent the next financial crisis, but they can lower its potential costs. (NYTimes)

Japan

Another look at the post-Kobe earthquake market analogy. (Bespoke)

Things to think about in the aftermath of the Japanese earthquake. (Planet Money, The Source, FT Alphaville, Megan McArdle)

Reinsurance prices are heading higher. (The Source)

The benefit of preparation. Strict building codes likely saved thousands of lives in Japan. (NYTimes)

The “supermooon” did not cause the earthquake. (Bad Astronomy, Dealbreaker)

Economy

Americans continue to cut their debt load…the hard way. (WSJ)

A big pop in retail sales. (Bloomberg)

Is Europe ready to deal with the Spanish problem? (Gavyn Davies, FT Alphaville, Crossing Wall Street)

Earlier on Abnormal Returns

What do frequent large price gaps tell us about the tension inherent in battleground stocks? (AR Screencast)

Does your investment approach face the market’s ‘wall of worry’ head on? (AR Screencast)

Our Friday morning live link look-in. (Abnormal Returns)

Mixed media

Have we fetishized startups? (GigaOM)

The race is on to create (and fund) group messaging services. (NYTimes)

The biggest changes to the NCAA basketball tournament in 25 years are coming to a TV near you. (USA Today)

Abnormal Returns is a founding member of the StockTwits Blog Network.