Quote of the day

Ray Dalio, “Currency devaluations are good for stocks, good for commodities and good for gold. They are not good for bonds.” (Barron’s)

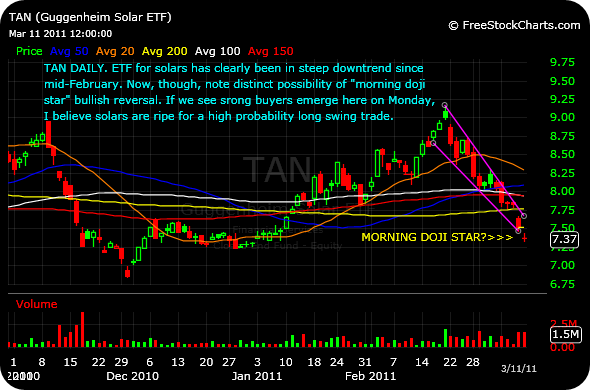

Chart of the day

Time for a turnaround in solar stocks? (chessNwine)

Markets

What happens to the S&P 500 after a long run above its 50 day moving average comes to an end? (WoodShedder)

Defensive sectors, like consumer staples and utilities, are leading the market at the moment. (Dragonfly Capital)

Equity sentiment is coming off its highs. (Bespoke)

Strategy

David Merkel, “Whatever you do, be consistent in your methods regarding momentum/mean-reversion, and only change methods if your current method is working well.” (Aleph Blog)

Don’t think that bonds can’t have big drawdowns. (World Beta)

How much should geopolitical events drive your investing? (The Fiscal Times)

Barton Biggs on market valuations and the attraction of blue chips. (ValuePlays)

Companies

Howard Schultz and the turnaround at Starbucks (SBUX). (NYTimes)

Why are China MediaExpress Holdings (CCME) shares still halted? (The Financial Investigator via Stone Street Advisors)

How much is the ‘smart cover’ worth to Apple (AAPL)? (Asymco)

Twitter seems willing to “bulldoze the ecosystem” that helped build its reach. (GigaOM)

Finance

Kid Dynamite, “Eric Sprott is filing so that he can sell all of his PSLV shares at any time.” (Kid Dynamite)

It is going to take more than a couple of self-nominated guys to regulate investment advisers. (WSJ)

The plot thickens in the dueling insider trading cases. (NetNet)

Japan

Can Japan’s economy withstand the costs to rebuild? (Curious Capitalist, ibid, Bloomberg, Breakingviews, WSJ)

More financial market reactions to the Japanese earthquake. (DJ Market Talk, MarketBeat)

Expect disruptions to the global supply chain from the Japan earthquake. (WSJ, NYTimes, @niubi)

Global

The EU reaches ‘a pact for the Euro.’ (WSJ, FT)

Three reasons why a Chinese economic slowdown is “imminent.” (Pragmatic Capitalism)

Why are foreigners so willing to hold US government debt? (Credit Writedowns)

Economy

The US nuclear “renaissance” is on hold for now. (WSJ, Politico, WashingtonPost, TheMoneyGoRound also Scientific American)

Two charts that show the domestic private and public credit flows. (Global Macro Monitor)

Cash on the balance sheets of corporate America continue to grow. (Real Time Economics)

Earlier on Abnormal Returns

Top clicks this week on Abnormal Returns. (Abnormal Returns)

Our Saturday long read linkfest. (Abnormal Returns)

Mixed media

The annual Barron’s survey on what broker is right for your trading style. (Barron’s)

Abnormal Returns is a founding member of the StockTwits Blog Network.