Quote of the day

Ashwin Parameswaran, “The routine jobs of 20th century manufacturing and services that were so amenable to creating mass employment are increasingly a thing of the past.” (Macroeconomic Resilience)

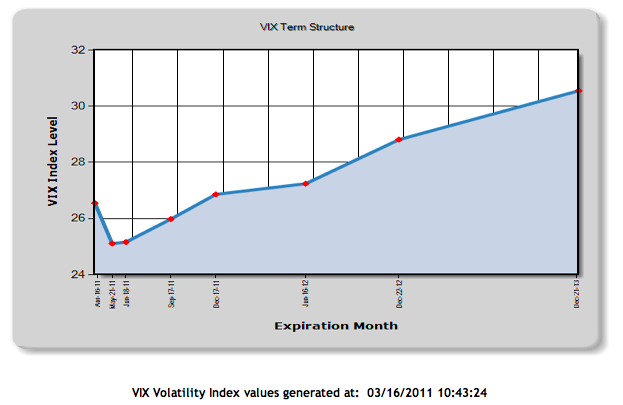

Chart of the day

The VIX has risen but the VIX futures curve has flattened. (CBOE)

Strategy

Carl Richards, “If you don’t have a plan, vow to make one.” (Bucks Blog)

How to displace emotion with analysis. (A Dash of Insight)

The blogosphere provides ample opportunity for you to engage in confirmation bias. (Big Picture)

Setting trading goals: flexibility vs. rigidity. (The Minimalist Trader)

On the prospects for margin compression. (Contrarian Edge)

Technology

Apple (AAPL) breaks down. (Bespoke)

The Kindle as an iPad accessory. (SAI)

Groupon continues to attract competitors. (CNNMoney, WSJ)

Funds

The information content inherent in ETF premia, the case of Japan ETFs. (IndexUniverse)

ETN use is on the rise. (ETFdb)

Where Jeff Gundlach is allocating money in a multi-asset portfolio. (Pragmatic Capitalism)

Finance

Interesting story that PIMCO shares are trading in the private market. (BetaBeat via TRB)

Prop traders are going to find the going tougher outside of a big firm. (Reuters)

Companies want investors to have to report 5%+ positions faster than they do today. (Dealbook)

Putting some (harsh) terms on a potential mortgage service settlement. (HuffingtonPost, Clusterstock)

Japan effects

Steven Pearlstein, “Our reward structures don’t encourage spending the time or the money to deal with low-probability disasters.” (WashingtonPost)

What damage has been done to the prospects of nuclear energy? (Smart Money Europe, Bespoke, MarketBeat)

Has natural gas’ day finally arrived? (Global Macro Monitor, WSJ, Fortune Finance)

Trying to get some measure of the macroeconomic effects of natural disasters. (Econbrowser, Paul Kedrosky)

Global

The situation in Bahrain. (Money Game, FT Alphaville)

Portugal catches a double credit downgrade. (Bloomberg)

The Swiss franc is the go-to safe haven currency. (The Source)

Has China won the war on inflation? (Money Game)

What is the worst case scenario for the Australian resource economy? (Macro Business)

Economy

The Fed keeps rates unchanged and an estimate of when we might see higher rates. (Mark Thoma, Gavyn Davies, Tim Duy, Aleph Blog)

New housing starts are scraping the bottom. (Calculated Risk, Planet Money)

March Madness for econ nerds. (Timothy Layton via Mankiw Blog)

Earlier on Abnormal Returns

Netflix (NFLX) is acting like an insurgent by disrupting the traditional business model of the TV networks. (AR Screencast)

Our Wednesday morning live link look-in. (Abnormal Returns)

Why your company should embrace March Madness. (Abnormal Returns)

Mixed media

Height and happiness. (Economix)

Jonah Lehrer, “There is nothing frivolous about play.” (The Frontal Cortex)

Abnormal Returns is a founding member of the StockTwits Blog Network.