Quote of the day

John Hempton, “Be very wary of fast-growing hyper profitable companies (especially companies in competitive industries) where the earnings are critically dependent on a reserve or variable that has to be estimated and on which the estimate is really a guess.” (Bronte Capital)

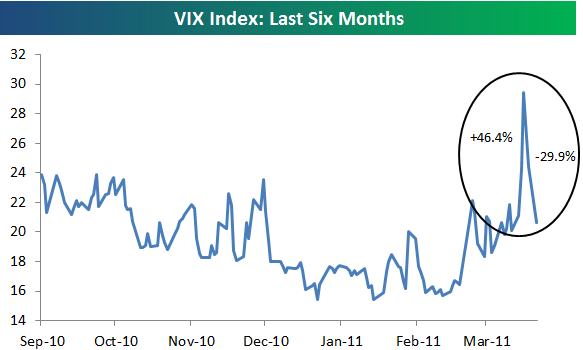

Chart of the day

Check out this whipsaw in the VIX. (Bespoke also Don Fishback)

Markets

Is that an ‘all-clear signal‘? (Big Picture, Free exchange)

Five extended stocks. (Afraid to Trade also Bespoke)

Market cap as a percentage of nominal GDP. (Big Picture)

The US dollar index is nearing a couple of multi-year lows. (Bespoke, The Technical Take)

High yield bonds continue on their merry way. (BondSquawk, Market Anthropology)

Is farmland the next, new bubble? (Project Syndicate)

Strategy

When to quit trading…for good. (Trader Habits)

An investor has got to have some rules. (The Reformed Broker)

John Paulson on the risk in risk arbitrage. (market folly)

It is always easier to hold a stock for the long term if you get the short term entry correct. (Derek Hernquist)

The returns from managed futures often come in fits and starts. (HedgeWorld)

Benchmarks matter: the case of gold. (All About Alpha)

When it comes to your finances don’t confuse the urgent with the important. (Bucks Blog)

Companies

It is going to take a while for the AT&T (T)-T-Mobile deal to close. (Dealbook, Bloomberg)

Ten de facto monopolies no one is talking about. (24/7 Wall St.)

Share buybacks are back. Look out. (Marketwatch)

Finance

“If bank stocks are the best investments you can find for your portfolio, you should fear for your (or your clients’) wealth.” (Value Institute via @jasonzweigwsj)

Are ETFs finally going to make a big push into 401(k) plans? (IndexUniverse)

Just how levered up are states and municipalities? (NetNet contra Money Game)

Global

Is there any good economic news to come out of the Japanese disaster? (tech ticker, Free exchange)

The bull case for Japan. (Money Game, ibid)

Does any one gain from the supply disruptions in Japan? (FT Alphaville, ibid)

UK inflation is heating up. (Bloomberg, Zero Hedge)

Prepare for a significant slowdown in China. (Pragmatic Capitalism)

Economy

Consumers are deleveraging. The big question is why. (Liberty Street Economics, FT Alphaville, Pragmatic Capitalism)

Truck tonnage fell in February. (Calculated Risk)

Commodity prices have been tracking global economic activity. (Economist’s View, bonddad blog)

On the difference between a good and bad economist. (Contrarian Edge)

James Picerno, “It’s easy to say the Fed’s makes mistakes and therefore it should be closed. But what’s the follow-up plan?” (Capital Spectator)

Economics research wants to be free. (Freakonomics)

Earlier on Abnormal Returns

ETFs are at best a proxy for an underlying market/sector. Why are some more popular than others? (AR Screencast)

Out Tuesday morning live link look-in. (Abnormal Returns)

Mixed media

The most successful companies have simple pricing plans. (Daring Fireball)

What some models are saying about the 2012 election. (Ezra Klein)

Your free will may not be all that free after all. (Scientific American)

Abnormal Returns is a founding member of the StockTwits Blog Network.