Quote of the day

Tyler Craig, “I’m always amazed when pundits have the gumption to make definitive statements about the market as if they know with surety what will come to pass.” (Tyler’s Trading)

Chart of the day

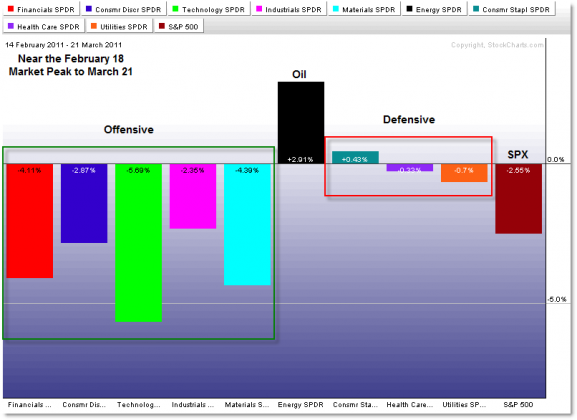

Checking in on relative sector performance. (Afraid to Trade)

Markets

What happens after a VIX whipsaw. (Quantifiable Edges)

Dollar weakness and the Bund-Treasury spread. (the research puzzle)

Forty years of market history in four minutes. (Market Anthropology)

Strategy

Financial media deja vu. (The Reformed Broker)

Burton Malkiel thinks you should have more invested internationally. (AAII)

Understanding the returns to the carry trade as a compensation for time-varying risk. (voxEU)

Finance

The Fed puts the brakes on a Bank of America (BAC) dividend hike. (WSJ, Street Sweep, Crossing Wall Street)

Exchange takeovers are going to take a while to close. (Bloomberg)

The Apollo Global Management IPO is coming at a discount to its peers. (Breakingviews)

Is the hedge fund industry at risk of greater regulation due to the taint from insider trading? (Project Syndicate, Economist’s View, Stone Street Advisors)

Technology

Don’t hold Google (GOOG) as the market digest Larry Page as CEO. (Forbes also The Reformed Broker)

Why Amazon (AMZN) needs to build its own Android device, pronto. (TechCrunch)

The battle for the consumer cloud is heating up. (Bloomberg)

iOS and Android are winning in part because they don’t come from the world of wireless telecom. (Asymco)

Funds

Five of the biggest ETF myths. (Kid Dynamite)

When market makers step away from ETFs during a crisis. (FT Alphaville, IndexUniverse)

How different index weighting schemes can create very different returns (and costs). (IndexUniverse)

Global

China now exceeds Japan in market capitalization. (Bespoke)

On the attractions of event-driven investing in Asia. (Institutional Investor)

Has global growth peaked? (FT Alphaville, ibid)

Discounting the death of the global supply chain. (Curious Capitalist)

Economy

The plunge in new home sales just keeps getting more spectacular. (Calculated Risk, Bespoke)

Can you tell the difference between economic pros and amateurs? (A Dash of Insight)

Checking in on the Billion Prices Project. (Pragmatic Capitalism)

Fire vs. furlough: which is the better approach for an economy? (Fortune Finance)

Absent a federal mandate don’t expect more realistic return assumptions from local pension funds any time soon. (WSJ)

Earlier on Abnormal Returns

Companies are increasingly likely to stay private these days. What are the implications for investors? (AR Screencast)

Our Wednesday morning live link look-in. (Abnormal Returns)

Mixed media

Movie theaters do NOT want you to know what is in their popcorn. (LATimes)

Where do bad moods come from? (The Frontal Cortex)

Abnormal Returns is a founding member of the StockTwits Blog Network.