Quote of the day

Nate Silver, “The problem with an overfit model is that, because it is so fussy about handling past cases, it tends to do a poor job of predicting future ones. ” (FiveThirtyEight)

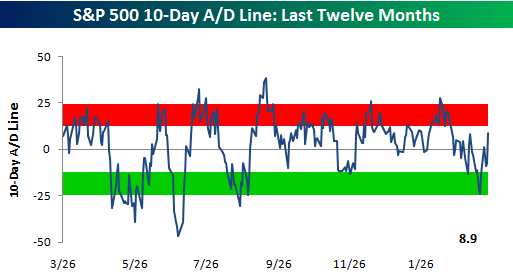

Chart of the day

The stock market reversal illustrated. (Bespoke)

Markets

Stuck in the middle with investor sentiment. (Pragmatic Capitalism)

The gold/silver ratio is plumbing multi-decade lows. (the research puzzle)

The gold and silver trade is back. (MarketBeat, FT Alphaville, TRB)

“The list of esoteric worries troubling the world’s investors is growing.” (Economist)

Over the past year there has been little relationship between analyst coverage and performance. (Bespoke)

Is there a Moore’s Law for corn? (The Reformed Broker)

Strategy

Don’t forget stocks AND bonds can have sizable drawdowns. (World Beta)

Uh oh. Calpers expects 5% real returns on its portfolio. (Falkenblog)

Eli Radke, “Trading is about change. No two trades are a like.” (Trader Habits)

Being right is overrated, redux. (Crosshairs Trader)

Just in case you missed it earlier, the seven immutable laws of investing. (Big Picture)

Technology

The next new social start-up, Color, raises big bucks pre-launch. (WSJ, TechCrunch, Searchblog, A VC)

Groupon vs. Facebook: which has the better opportunity in front of them? (Atlantic Business)

Funds

There are now ETNs to bet on individual government bond markets. (ETFdb, Random Roger)

A head-to-head ETF comparison tool. (ETFdb)

Finance

Is the falling number of US listings necessarily a bad thing? (Free exchange, Felix Salmon, Modeled Behavior)

Is a US small cap exchange the next new thing? (Trading Places)

The Fed is going to have to show some its bank bailout cards. (naked capitalism)

Why did the Fed allow banks to raise dividends? (Baseline Scenario)

Hedge funds

Blackstone Group (BX) has become a hedge fund powerhouse. (Reuters)

Third party investors are less likely to buy into hedge fund managers these days. (WSJ)

Hedge funds are putting on a push to convince regulators they are not a systemtic risk to the financial system. (Absolute Return+Alpha)

Global

China has a demographic problem. (Global Macro Monitor)

The world’s economic center of gravity keeps moving East. (FT Alphaville)

The Brits’ sticky wicket when it comes to budget austerity. (MarketBeat)

Portugal, when not if. (Big Picture, Curious Capitalist)

Portugal will not take down Spain. (Street Sweep)

Economy

Tim Duy, “The Fed very much needs to keep an eye on actual wage pressures, not hypothetical inflation pressures.” (Economist’s View)

A “small, positive note” for the employment outlook. (Calculated Risk, Capital Spectator)

What it would take to see a marked improvement in the jobs picture. (A Dash of Insight)

The labor participation rate is projected to continue declining. (Economix)

Nominal vs. real growth in US housing. (Visualizing Economics also naked capitalism)

Rail traffic continues to surge. (ValuePlays)

This recession also featured a slowdown in startups. (Real Time Economics)

Are CEOs overpaid? (Mark Thoma)

Mixed media

Our Thursday morning live link look-in. (Abnormal Returns)

What has happened to the supply of music post-Napster? (SSRN)

Abnormal Returns is a founding member of the StockTwits Blog Network.