Quote of the day

Eric Falkenstein, “Investment managers can live with bad luck, but their reputation is essential and they can’t be seen a fool.” (Falkenblog)

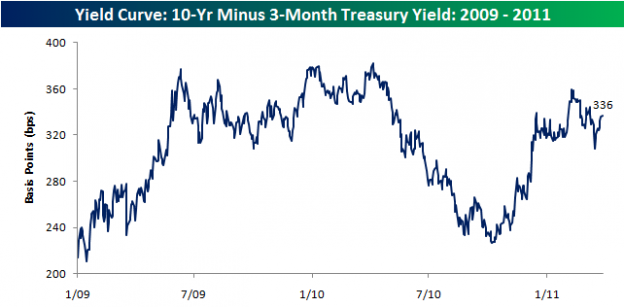

Chart of the day

Ignore the slope of the yield curve at your own peril. (Bespoke)

Video of the day

Consuela Mack interviews Niall Ferguson. (WealthTrack)

Markets

Market breadth is at bull market highs. (Bespoke)

Options on the oil market point to an acceptance of higher prices. (Investing With Options)

The market portfolio could be a great deal more diversified. (All About Alpha)

Strategy

Overfit financial models “go dull” quite quickly. (Portfolio Probe)

“Cash is today. Investing is tomorrow. Tomorrow is risk. The risk of holding cash is tomorrow. The risk of investing is tomorrow’s today.” (I Heart Wall Street)

Strom, “Traders, take note. Sometimes the best trades are those on the periphery; the less obvious, once or twice-removed reactions to an initial situation.” (Strom Macro)

Just in case you had forgotten, leverage kills. (Tyler’s Trading)

Revisiting the folly of forecasting. (Big Picture)

Research

Checking in on the end of the quarter effect. (CXO Advisory Group)

Are stocks really less risky over the long run? (SSRN)

How investor relations and media coverage effects stock returns. (SSRN)

Eric Jackson, “Analysts can make repeated bad calls for years — with no consequences.” (Forbes)

Female sell-side analysts seem to do a better job at picking stocks. (SSRN)

Companies

eBay (EBAY) is changing its stripes to better compete with Amazon (AMZN). (Deal Journal)

Does the St. Joe’s (JOE) land have value? (ValuePlays)

Social media

Social media is just beginning to scratch the surface of the investment world. (Ivanhoff Capital)

Talking with a true believer in social media. (The Reformed Broker)

Not every social media startup is going be successful, let alone survive. (NYTimes also Howard Lindzon, Institutional Investor)

This wave of startup investing is likely not a bubble. (Points and Figures)

Finance

Past private equity fundraising implies a rush of deals to come. (WSJ)

Should high frequency trading be banned? (Freakonomics)

Global

Just how big was the drop off in world trade due to the financial crisis? (FT Alphaville)

They call them emerging markets for a reason. (The Reformed Broker)

Economy

Estimates of Q1 GDP is likely to get downgraded. (Calculated Risk)

Is this employment recovery all that different than the last two? (ValuePlays)

What to expect from a new era of Fed openness. (The Reformed Broker)

There is no such thing as an ‘average American household.’ (EconLog, Marginal Revolution)

Mixed media

Our Monday morning live link look-in. (Abnormal Returns)

Want to relive 2008? Watch the movie “Margin Call.” (Dealbreaker)

All the apps you need to get in gear for Opening Day. (Wired)

Abnormal Returns is a founding member of the StockTwits Blog Network.