Quote of the day

Tyler Craig, “Like a drug, charts can be both used and abused.” (Tyler’s Trading)

Chart of the day

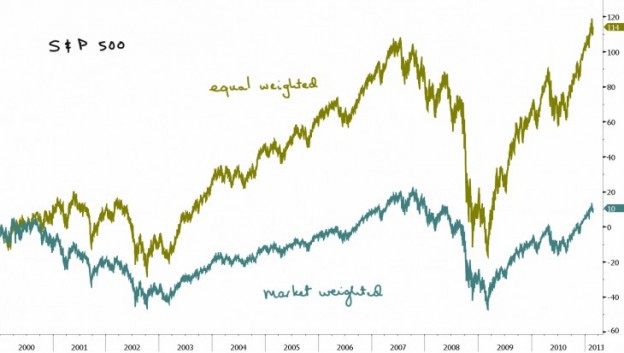

How much longer can equal-weighted strategies outpeform? (the research puzzle)

Markets

What to make of the VIX whipsaw? (Outside the Box, The Buzz, FT Alphaville)

A look at the valuation of the S&P 500. (Crossing Wall Street)

Cotton is the new gold. (NYTimes also Points and Figures)

A good argument for ETFs; the uncertainty of fair value pricing. (Morningstar)

Strategy

Trading the gold miners vs. gold. (Dynamic Hedge)

Options are not for everyone. (Options for Rookies)

How to achieve an optimal trading frame of mind. (Stock Sage)

Investor sentiment and the returns to investment anomalies. (SSRN)

IPOs

Hong Kong is the new hot spot for brand name IPOs. (Deal Journal)

Some thoughts on the Apollo Group IPO. (Street Sweep)

SecondMarket is reportedly looking to disintermediate venture capital firms. (peHUB)

Check out the downtrend in IPOs. (Bespoke)

Finance

Ronald Barusch, “How does a deal with Berkshire differ from a leveraged buyout sponsored by a private equity fund?” (Deal Journal)

Hedge funds are slowly looking to clear out their side pockets. (Dealbook)

The strategic dilemma facing Nasdaq OMX (NDAQ). (Marketwatch)

Private equity in Brazil lives on a debt-free diet. (Dealbook, Felix Salmon)

Global

Greece=Argentina. (The Street Light)

Foreign land investors are hot on Africa. (The Source also market folly)

How complexity works against nuclear energy. (Gregor Macdonald)

Can the boom in Canadian house prices last? (WSJ)

Economy

All eyes on the end of QE2. (Tim Duy, The Source, Credit Writedowns)

Housing prices dropped in January everywhere but Washington DC. (Calculated Risk, Free exchange, Big Picture, TRB)

The price-to-rent ratio keeps falling. (Modeled Behavior, Calculated Risk)

How the Fed helped nursed sick banks along. (Bloomberg)

Inflation vs. changes in relative prices. (Atlantic Business)

How real are recent productivity gains? (Mandel on Innovation)

State and local government revenue is at a new record high. (Carpe Diem)

The top 10 dying industries. (Real Time Economics)

Earlier on Abnormal Returns

The stock market is wondering when (and how) will corporate America put its cash hoard to work. (AR Screencast)

How the market can string some traders along. (Abnormal Returns)

Our Tuesday morning live link look-in. (Abnormal Returns)

Mixed media

Recent hires and goings on at StockTwits. (TechCrunch, IRWebReport, Tradestreaming, SAI)

Seven reasons why every investor should write. (Eric Jackson)

Nobody likes to think a computer can do their job. (Falkenblog)

Abnormal Returns is a founding member of the StockTwits Blog Network.