Quote of the day

Cullen Roche, “The treasury market is sending a loud message, however – those calling for hyperinflation, default or even high inflation are dead wrong.” (Pragmatic Capitalism)

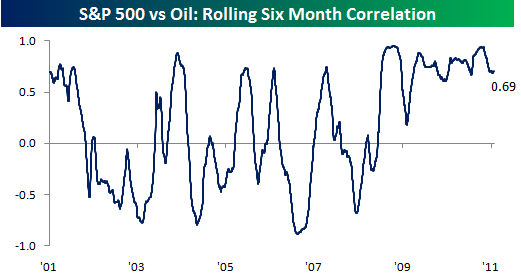

Chart of the day

Equities and oil have been highly correlated for some time now. (Bespoke)

Commodities

The set-up for falling crude oil prices. (Afraid to Trade)

A big chunk of the speculative element in silver been washed away. (Stock Sage, Market Anthropology)

Allen Mattich, “In the context of global asset markets, silver is tiny.” (The Source)

Markets

Stock buybacks are ramping up. (WSJ)

On the surprising attraction of TIPS with negative yields. (Marketwatch)

Do we really need a new dollar index? (research puzzle pix)

Why should any one expect a Cisco (CSCO) restructuring to work? (Herb Greenberg)

Strategy

Overheated markets are always justified with ‘this time it is different’ arguments. (Trader’s Narrative)

Traders who use a trading coach. (WSJ via Points and Figures)

The reverse Peter Lynch effect. (Leigh Drogen)

Stuff to watch/listen

A talk with Chris Green of ETF Replay. (Tradestreaming)

Mike Bellafiore talks trading with the college crowd. (SMB Training)

Finance

Why it is futile to prevent a market crash. (Marketwatch)

The only way to remove systemic risk from the financial system is to “make the banks scream.” (Aleph Blog)

Meet the fastest growing fund company ever, Doubleline Capital. (Pensions & Investments)

The Feds keep sniffing around Stevie Cohen and SAC Capital. (Dealbreaker, Deal Journal, NetNet)

A profile of the head of Norway’s sovereign wealth fund. (Businessweek)

Economy

Non-farm payrolls surprise to the upside. (Calculated Risk, Capital Spectator, Real Time Economics, Free exchange, Economix, Economist’s View)

Why companies are having to start hiring again. (Street Sweep, Daniel Gross)

The longer term issues facing the US jobs engine. (Gavyn Davies)

Rail traffic (and truck traffic) rebound. (ValuePlays, Carpe Diem)

The Taylor Rule and QE2. (Econbrowser)

Earlier on Abnormal Returns

ARTV with Zack Miller of New Rules of Investing and Tradestreaming. (Abnormal Returns)

What you missed in our commodity-laden Friday morning linkfest. (Abnormal Returns)

Mixed media

Happy third blogiversary to Jay. (market folly)

Social investing is in its infancy. No wonder so few get it. (The Reformed Broker)

On the sad state of the US horse racing industry. (Businessweek, Time)

Abnormal Returns is a founding member of the StockTwits Blog Network.