Quote of the day

Howard Lindzon, “Using calls to action in financial headlines is at best linkbaiting and at worst financially dangerous and irresponsible.” (Howard Lindzon)

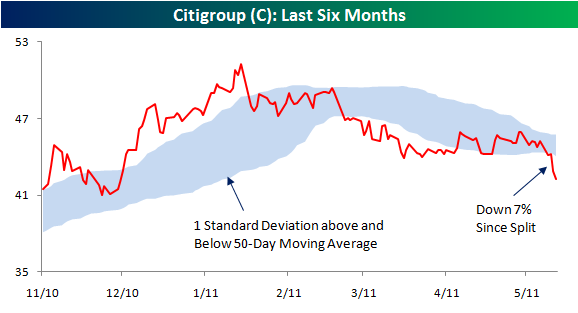

Chart of the day

How is that reverse-split working out for Citigroup (C)? (Bespoke)

Markets

There’s always a wall of worry for the market to overcome. (Pragmatic Capitalism)

The US dollar index is showing some life. (Bespoke)

What is the common factor between commodities and equities? (research puzzle pix)

There a quant explanation for commodities underperformance. (HedgeWorld)

Trading the spread between gold and gold miners. (Dynamic Hedge)

Strategy

Tom Brakke, “Just as a fraudulent stock can cause grievous harm to a portfolio, a widely-held investment thesis gone wrong can disrupt the very nature of the investment ecosystem.” (the research puzzle)

Cash as the ultimate diversifier. (The Source)

It is harder to accumulate capital than it is to lose it. (Data Diary)

The entire Jeremy Grantham ‘risk off’ letter. (Fund My Mutual Fund, Street Sweep)

Companies

Will Whitney Tilson’s short of SalesForce.com (CRM) work out any better than his Netflix trade? (TechInsidr)

Sears Holdings (SHLD) is a mess. (Term Sheet)

Has Netflix (NFLX) been able to successfully transform its business? (Megan McArdle)

Why would any one pay up for Toyota Motor (TM) shares? (ValuePlays)

Finance

Exchange margins are not set in a vacuum. (Points and Figures)

MIT issues a 100-year bond. (MarketBeat)

Funds

On the dangers of the ETF-ization of everything. (Kid Dynamite)

Commodity ETFs as warehouses for the big banks. (FT Alphaville)

Do ETFs-of-ETFs make sense? (IndexUniverse)

Insider trading

What’s worse: ripping off your clients or insider trading? (Cassandra Does Tokyo)

The implications of the Raj Rajaratnam case for Wall Street, i.e. more wiretaps. (NetNet, NYTimes, Dealbook, WSJ)

Starbucks (SBUX) is the new hot spot of all sorts of illicit activity, including insider trading. (WSJ)

Global

Is the Euro priced for perfection? (Market Anthropology)

How difficult is it to legally exit the Euro? (FT Alphaville, ibid)

Stagflation in the UK. (Gavyn Davies)

Economy

Weekly initial jobless claims continue to struggle to show strength in the jobs market. (Calculated Risk, Capital Spectator)

Producer price inflation is here. (Atlantic Business, Calafia Beach Pundit)

How much is housing holding back the economic recovery? (macroblog)

What “demand destruction” is and more importantly isn’t. (A Dash of Insight)

Earlier on Abnormal Returns

What you missed in our Thursday morning linkfest. (Abnormal Returns)

Mixed media

An inside look at the inner workings of the StockTwits Blog Network. (The Reformed Broker)

Some favorite economic blogs. (Bonddad Blog)

A review of How to Smell a Rat by Ken Fisher. (Aleph Blog)

A review of Too Big To Fail, the movie. (Felix Salmon)

Thanks for checking in with Abnormal Returns. For all the latest you can follow us on StockTwits and Twitter.