Quote of the day

Jim Jubak, “Safety carried to excess is the exact antithesis of safety.” (Jubak Picks)

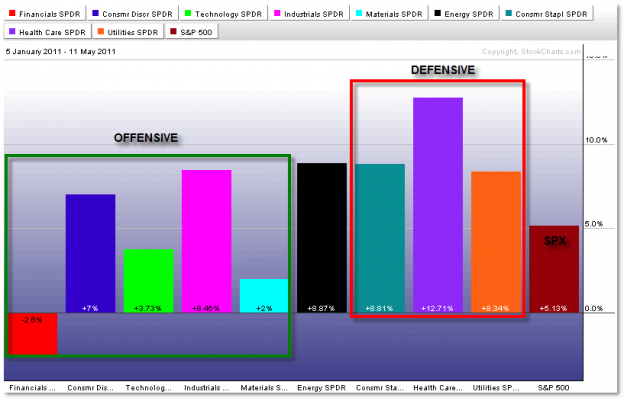

Chart of the day

What does the Sector Rotation Model reveal about the current market situation? (Afraid to Trade)

Markets

Some of last year’s laggards are playing catch-up. (Bespoke)

Any seasonality in oil prices? (CXO Advisory Group)

What’s the right period of historical volatility to compare to implied volatility? It depends. (InvestorPlace)

Strategy

Protecting yourself against the claims of management. (AlphaTrends)

Selling into strength doesn’t mean trying to catch the top. (Leigh Drogen)

Howard Marks on the many ‘most important things for investing.’ (Dealbook)

Brett Arends, “There are no shortcuts to wealth.” (WSJ)

A “hot” fund tip. (CBS Moneywatch)

Companies

Is political rhetoric putting a lid on oil stock prices? (Businessweek, Curious Capitalist)

Burlington Northern is thriving under Berkshire Hathaway (BRKA). (Businessweek)

David Tepper favorite Dean Foods (DF) catches an upgrade. (Money Game earlier AR Screencast)

Tech

Yahoo! (YHOO) has a Alibaba problem. (Deal Journal, MarketBeat, Bits, Breakingviews)

Salesforce.com (CRM) is not trading on current earnings. (research puzzle pix)

Time for John Chambers to go at Cisco (CSCO). (SAI)

Steve Ballmer needs to go. (The Brooks Review)

In defense of Ballmer and Chambers. (Peridot Capitalist)

How this tech “bubble” is different than the last. (Economist)

A primer on those who have stock options in a startup. (Chris Dixon)

Finance

AIG (AIG) is making the case for its stock on a road show. (WSJ)

Despite commodity volatility, the Glencore IPO is well oversubscribed. (24/7 Wall St., The Source)

The challenge of hedge fund succession and the chances more operators go public. (Reuters)

Money market mutual funds have to-date avoided much additional regulation. (Economist)

BATS Global Markets is going public. (Dealbook, Bloomberg)

The 100 largest hedge funds. (Institutional Investor, TechInsidr)

Global

Could the Euro crisis threaten the EU itself? (Confessions of a Macro Contrarian)

The economic split in Europe is getting more stark. (Free exchange, Money Game, The Source, NYTimes)

Economy

Should we believe core or headline inflation? (Capital Spectator, Atlantic Business, Economix)

An insider’s guide to the debt ceiling debate. (A Dash of Insight)

Don’t assume your Roth IRA is tax-free forever. (Megan McArdle)

Earlier on Abnormal Returns

A wide-ranging edition of ARTV with Edward Harrison of Credit Writedowns fame. (Abnormal Returns)

Before Jim Cramer was JIM CRAMER he helped democratize the financial media. (AR Screencast)

What you missed in our Friday morning linkfest. (Abnormal Returns)

Mixed media

Why do we so often get risk wrong? (Nature via Freakonomics)

The power of “small wins” on problems in business (and life). (HBR)

Cool graphic of the day: the US center of population 1790-1910. (Economix)

Abnormal Returns is a founding member of the StockTwits Blog Network.