Quote of the day

TED, “Nine times out of ten, I suspect the person whining is just pissed off he did not get shares in a hot IPO himself.” (The Epicurean Dealmaker)

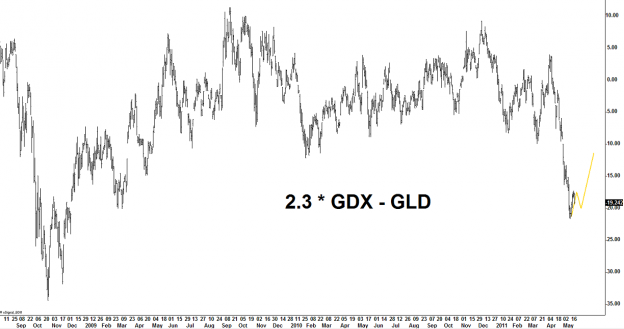

Chart of the day

The price of the big gold miners has languished compared to the metal. (Dynamic Hedge also Barron’s, StockCharts Blog)

Markets

On the strength in the “defensive block.” (Afraid to Trade)

Equity market sentiment at week-end. (Trader’s Narrative)

A look at POMO and the stock market. (Quantifiable Edges)

For many traders the LinkedIn news was all a sideshow. (Derek Hernquist)

Larry Summers thinks we have a tech bubble. (The Reformed Broker)

Fear is the product many in the media peddle. (Pragmatic Capitalism)

Bonds

Treasury investors should fear “financial repression” more than an actual default. (WSJ)

Muni bonds are no longer cheap compared to Treasuries. (WSJ)

Corporations are facing “optimal” debt financing conditions at the moment. (FT)

Real interest rates, the end of QE2 and gold prices. (FT)

Strategy

Building a better asset allocation model. (Aleph Blog)

Bias can affect the way you look at charts. (Investing With Options)

Entries and exits are only a small part of any trading system. (Rogue Traderette via Chicago Sean)

The real reason for portfolio rebalancing. (CBS Moneywatch)

On the difference between fund management and farming. (Bloomberg)

Companies

Many have underestimated the effect of retail stores on Apple’s success. (GigaOM)

On the sad state of affairs at Sears Holdings (SHLD). (research puzzle pix)

More people are spending more money with Amazon (AMZN). (GigaOM)

How has John Malone’s dealmaking worked out and what he sees in Barnes & Noble (BKS). (Deal Journal, Dealbook)

As the LinkedIns of the world garner all the attention, yesterday’s tech titans languish. (WSJ)

Finance

How the IPO underwriting process works. Did LinkedIn (LNKD) get “scammed”? (The Epicurean Dealmaker contra Joe Nocera)

What are we to make of the recent underperformance of Goldman Sachs (GS) stock? (Market Anthropology, Clusterstock, Crossing Wall Street, Reuters)

Profiles of a public fund that seeks to buy shares in the private, secondary market. (peHUB, Forbes)

Another convertibles ETF launches. (IndexUniverse)

Public vs. private markets: a pension fund perspective. (Pension Pulse)

Global

You may be underweight China and not even know it. (IndexUniverse)

Is Vietnam the next China? (Free exchange)

Now Europe is dissatisfied with China’s trade policies. (NYTimes)

Economy

What can we say about the job prospects of the long term unemployed? (Rortybomb)

What the rise of the font Helevetica tells about economies of scale. (FT)

Why the media shifted from talking about unemployment to the deficit. (Rortybomb)

On the importance of reversing the “toxic” climate for business in Chicago. (New Geography)

Earlier on Abnormal Returns

What you missed in our Saturday longread linkfest. (Abnormal Returns)

Top clicks this week on Abnormal Returns. (Abnormal Returns)

Mixed media

On the (literal) pain of being an entrepreneur. (Altucher Confidential)

The future of social media is verticals. (Howard Lindzon)

Sorry folks, there is no great secret to success. (Chris Perruna)

Abnormal Returns is a founding member of the StockTwits Blog Network.