Quote of the day

Tyler Craig, “Don’t sacrifice your performance on the altar of diversification.” (Tyler’s Trading)

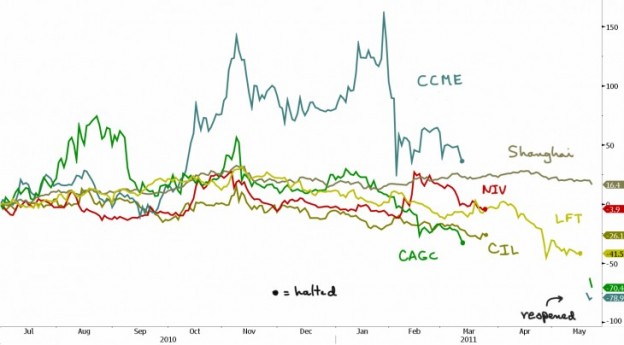

Chart of the day

The red chip reversal illustrated. (research puzzle pix also TRB)

Markets

Financials keep on underperforming. Buy banks! (Bespoke, MarketBeat, ibid)

A look at some conflicting measures of risk appetites. (Data Diary also Big Picture)

What effect will the end of QE2 have on investor psychology? (Market Anthropology)

Stock market returns around Memorial Day. (CXO Advisory Group)

The US dollar is threatening to break its long term downtrend. (Bespoke)

Strategy

What asset classes perform best in a period of negative real interest rates. (World Beta)

Gold is not an investment. (Bucks Blog, Big Picture)

Why everyone should learn to invest. (Ivanhoff Capital)

CDs these days are no place for anyone looking for real, after-tax returns. (InvestmentNews)

Some lessons from a year of tough trading. (Peter L. Brandt)

Companies

A healthy debut for Yandex (YNDX). (Term Sheet, Dealbook, 24/7 Wall St.)

The case for, wait for it, Cablevision (CVC). (Deal Journal)

Investors want their energy companies focused. El Paso (EP) plans a spinoff. (Dealbook, 24/7 Wall St.)

Fusio-io as a proxy on Facebook. (Term Sheet, AllThingsD)

Funds

More criticism of the ETF industry. (FT Alphaville, ibid)

Everybody and his brother wants to launch an actively managed ETF these days. (WSJ, Focus on Funds)

Institutions are increasingly embracing the use of ETFs. (IndexUniverse)

Finance

Why haven’t investors fled from SAC Capital yet? (Street Sweep)

Some hedge fund managers are turning to ‘first-loss capital‘ to help launch and expand. (Marketwatch)

Nicholas Carlson, “In other words, even in the private markets, the stock-promotion game is already alive and well.” (SAI)

Why don’t hot social media companies do dutch auction IPOs? (Josh Brown)

Global

Greece needs a strategic plan. (Credit Writedowns)

CIVETS vs. BRICs. (Floyd Norris)

The ugly future ahead for Europe’s banks. (The Source, Bloomberg, Buttonwood)

Economy

Are we any nearer to the end of the foreclosure crisis? (Curious Capitalist, Atlantic Business)

Home sales moving “sideways at a low level.” (Calculated Risk)

Can an economy simply stall out? (Econbrowser)

A great argument for more immigration. (Carpe Diem)

Why there is so much fuss about core vs. headline inflation. (Capital Spectator)

What the movie ‘Bridesmaids‘ tells us about small business and the economy. (new deal 2.0)

Earlier on Abnormal Returns

On the challenges of weighing short demand and long term supply trends in the energy sector. (AR Screencast)

What you missed in our Tuesday morning linkfest. (Abnormal Returns)

Mixed media

Online investors are embracing social media as source of investment ideas. (Globe and Mail)

Barry Ritholtz, “Anyone can take any technology and abuse it to the point of foolishness.” (Big Picture)

Om Malik, “What works in Blogging: Be yourself, be intellectually honest and be respectful of others – their work, their words and most importantly the attention they accord you.” (Om Malk)

Even the most popular bloggers can not make a living off of advertising. (Gonzalo Lira via eWallStreeter)

Well written customer reviews are more important that good ones. (Felix Salmon also Scientific American)

In praise of The Browser and a look at the economics of curation. (Free exchange)

Abnormal Returns is a founding member of the StockTwits Blog Network.