Quote of the day

Raghuram Rajan, “Clearly, someone is paying a price for ultra-low interest rates: the patient and uncomplaining saver.” (Project Syndicate via Credit Writedowns)

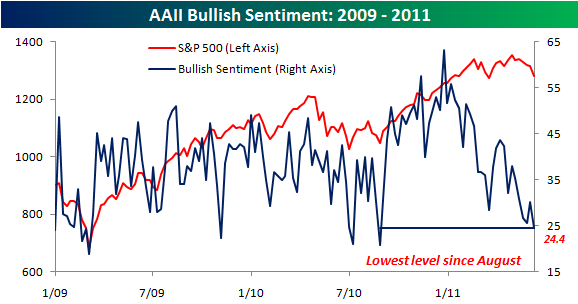

Chart of the day

Bullish sentiment has evaporated. (Bespoke)

Markets

The faltering economic recovery gets front cover treatment from Time. (Money Game)

On the prospects for Japanese-level, sub-3%, US Treasury yields. (Big Picture, FT Alphaville also Calafia Beach Pundit)

Risk aversion at work in the bond market. (Dragonfly Capital)

Still little sign of financial stress. (Capital Spectator)

Strategy

What say the Fed Model? (Bespoke)

Can market timers actually time the market? (CXO Advisory Group)

How to spot a bubble in real time. (Big Picture, All About Alpha)

A value investing roundtable. (Contrarian Edge)

Traders need to “live to fight another day.” (chessNwine)

Erik Swarts, “Tweet, text, type, trade.” (Market Anthropology)

Companies

Banks should be doing better at this point in the cycle. (WSJ contra Market Anthropology)

Why are people so willing to pay up for a lunch with Warren Buffett? (Insider Monkey)

Big data is here. The question is how to profit. (The Reformed Broker)

Funds

Funds are beginning to regret their foray in Chinese shares. (WSJ, ibid)

Pimco to launch an actively managed currency ETF. (IndexUniverse)

Oh if investing were only this easy. (research puzzle pix)

Finance

We have a two-tier IPO market. Technology, yes. Everything else, maybe. (Dealbook)

To get a sense for Groupon, look to the founders prior IPOs. (peHUB also Points and Figures)

Are you really a hedge fund if you have 62% of your assets in one position? (Deal Journal)

A private equity guy thinks private equity guys are overpaid. (Deal Journal)

Is high frequency trading ready for more regulation? (Dealbook)

Global

Three big, hairy global macro crosscurrents. (Confessions of a Macro Contrarian)

Three sovereigns are coming to market. (FT Alphaville)

Inverted yield curves in India and Brazil. (Reuters)

What exposure do US banks have to Greece? (Fortune)

The US catches a downgrade via Germany. (Smart Money Europe)

Economy

Initial unemployment claims continue to disappoint. (Calculated Risk, Calafia Beach Pundit)

The ISM new orders/inventories ratio isn’t signalling trouble, yet. (Pragmatic Capitalism)

What is the US going do with all that natural gas? (New Geography)

Global demand for coal is seemingly insatiable. (Gregor Macdonald)

Making the case for regulating antibiotic use. (Marginal Revolution)

Corn does not want to go down. (Fortune)

Earlier on Abnormal Returns

What you missed in our Thursday morning linkfest. (Abnormal Returns)

Mixed media

Need to value a company? There is an app for that. (Musings on Markets)

Managing information flow in this day and age is tough. (World Beta)

Sex scandals as an indicator of social mood. (Minyanville)

On the importance of a disaster-tolerant approach to life. (Seth Godin)

Abnormal Returns is a founding member of the StockTwits Blog Network.