Quote of the day

Sean McLaughlin, “Comparing yourselves to others is a sure recipe for failure. ” (The Minimalist Trader)

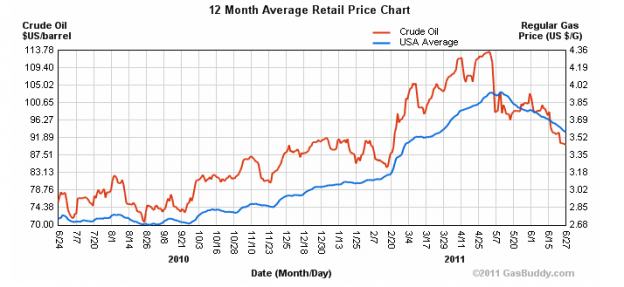

Chart of the day

Gasoline prices should continue to come down. (Money & Co., GasBuddy)

Markets

Bears are in charge around the world. (Humble Student of the Markets)

Who’s right on earnings? Analysts or strategists? (Big Picture, WSJ)

Wheat vs. corn: a historical perspective. (Peter L. Brandt)

Why there may be more demand for Treasuries than commonly thought. (Economic Musings)

Funds

Do you remember when the Fidelity Magellan fund was by far and away the industry bigfoot? (research puzzle pix)

A bond fund innovation worth noting – target maturity funds. (Morningstar)

Three ETFs not worth your time or money. (ETFdb)

Strategy

How to optimize your “idea factory.” (Tyler’s Trading)

Overnight returns as an indication of the messed up relationship between risk and return. (Falkenblog)

Just because you can borrow doesn’t mean you should. (Bucks Blog)

Oil

Oil sentiment is particularly bearish. (Trader’s Narrative)

The move by the IEA does nothing to affect the long term situation with oil. (Econbrowser)

More on the WTI-Brent spread. (Focus on Funds)

Companies

The highest yielding technology stocks. (Bespoke)

Why there is no deal for Research in Motion ($RIMM) on the horizon. (Asymco)

Finance

How to think about the new, higher capital requirements for systematically important banks. (NetNet, Felix Salmon, MarketBeat)

“Accelerated share repurchases” are rebounding in popularity. (FT)

The guy who might run Goldman Sachs ($GS) one day. (Dealbreaker, NetNet)

PE vs. VC

GSV Capital ($GSVC) joins the Facebook parade. (Dealbook, WSJ, TechCrunch, SAI)

PE employees beware. You have to be in it to win it. (Felix Salmon, Term Sheet)

In defense of taking some money off the table. (Term Sheet)

Global

What price a AAA-downgrade? (FT Alphaville, Atlantic Business)

One of these days the Euro is going to get whacked. (The Source)

Gary Shilling joins the hard landing camp for China. (Bloomberg)

Economy

A positive sign on the manufacturing front. (Bespoke)

Truck tonnage fell in May. (Calculated Risk)

Just how artificial is the current economic recovery? (Pragmatic Capitalism)

On the 10% gap between potential and actual GDP. (Calafia Beach Pundit)

Earlier on Abnormal Returns

On the importance of recognizing when you have lost your edge – the case of managed futures. (AR Screencast)

Why doing less often means more. Michael Mauboussin talks with Consuelo Mack. (Abnormal Returns)

What you missed in our Monday morning linkfest. (Abnormal Returns)

Mixed media

Brenda Jubin, “The normal trading book takes about ten solid pages of ideas and stretches them to two hundred or so. The advantage of The StockTwits Edge is that it is concentrated.” (Reading the Markets)

A rave review for Tim Harford’s Adapt. (Portfolio Probe)

Why your bagel sucks. (Slate)

Abnormal Returns is a founding member of the StockTwits Blog Network.