Quote of the day

Mike Konczal, “There’s no silver lining in today’s job numbers.” (Rortybomb)

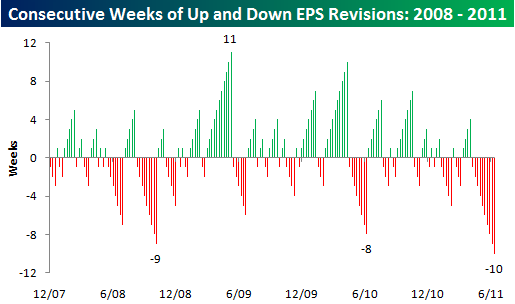

Chart of the day

Analysts keep on cutting earnings estimates. (Bespoke)

Markets

Keeping an eye on junk bonds as a risk-on/risk-off indicator. (Dragonfly Capital)

The divergence between the Wilshire 5000 and Wilshire 4500 is striking. (Crossing Wall Street)

Quite a month for a couple of hedge funds. (Dealbook, Institutional Investor)

Strategy

When will profit margins mean revert? (The Source)

A lost decade for Medtronic ($MDT). (research puzzle pix)

Advisors and their clients have very different concerns. (Data Diary)

Options

Why is the VIX so calm at the moment? (MarketBeat)

Three questions options traders need to ask themselves. (Investing With Options)

Free stuff Friday. Download a free ‘best of’ edition of Expiring Monthly. (Condor Options)

Finance

Has finance displaced our ability to create companies like $AAPL? (Pragmatic Capitalism)

Time to start taxing carried interest like the ordinary income that it is. (Term Sheet)

The rich get richer as elite VC firms profit from the Internet/social media IPO boom. (WSJ)

ETFs

Comparing the sector weights of various commodity ETPs. (AllETF)

What ETFs have the most shares out on loan? (MarketBeat)

A slew of new, niche international ETFs is on the way. (ETFdb)

Comparing broad-based Japan equity ETFs. (IndexUniverse)

Global

Why a European Treasury was never created. (Credit Writedowns)

Alberta has oil. Now all it needs is a pipeline to send it somewhere. (WSJ)

Economy

No matter how you spin it a bad June employment report. (Calculated Risk, Bloomberg, Business Insider, Points and Figures, Economix, Pragmatic Capitalism, EconomPic Data, Daily Ticker, Atlantic Business, Curious Capitalist)

The ECRL WLI is still slowing. (MarketBeat)

What policy options does the Fed have at the moment? (Real Time Economics)

Why are infrastructure projects so prone to cost overruns? (Bloomberg)

Earlier on Abnormal Returns

What you missed in our Friday morning linkfest. (Abnormal Returns)

Mixed media

Grading CFA exams has become a big deal. (Dealbreaker)

How IPOs, or any cash windfall, can kill you. (Infectious Greed)

Abnormal Returns is a founding member of the StockTwits Blog Network.