Quote of the day

Julie Moos, “..there is no replacement for that scout who looks ahead and leads you safely around the curve you might not otherwise have seen coming. That’s what the best aggregation does.” (Poynter)

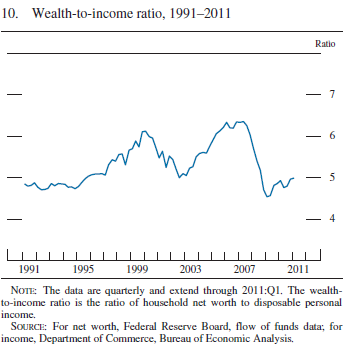

Chart of the day

Why Americans feel so poor. (Federal Reserve via Atlantic Business)

Markets

Stock correlations are rising once again. (Ticker Sense)

Copper is breaking out. (Bonddad Blog)

Keeping an eye on currencies as a clue to the markets. (Market Anthropology)

Muni bonds just keep on chugging. (MarketBeat)

Strategy

Trading is tough. Just how tough? (Big Picture)

Being a financial advisor is tough. Just look at their clients. (Felix Salmon)

Tyler Craig, “If you’re participating in a perpetual search for assured outcomes as you hop from one strategy to another, allow me to save you some time. They don’t exist.” (Tyler’s Trading)

“Simple is best” for trading systems. (Don Fishback)

Companies

What now for News Corp. ($NWS)? (Term Sheet, Rational Irrationality)

Netflix ($NFLX) killed Blockbuster. Now what? (Big Picture also Term Sheet)

A look at Garmin’s ($GRMN) “ridiculous” dividend yield. (YCharts Blog)

Finance

The spinoff wave continues, today ConocoPhilips ($COP). (Crossing Wall Street, Insider Monkey)

What IS the right tax rate for futures contracts? (Points and Figures)

Technology

The ubiquitous 5-star rating system is flawed. (GigaOM)

Are tablets the new PCs or post-PC? (Asymco)

The US has a looming bandwidth problem. (WSJ)

Is Facebook worth $100 billion? (WSJ)

Another fund focused on buying into still-private tech companies, Keating Capital ($KIPO) goes public. (FT)

Global

Why a smaller Eurozone is the likely outcome. (Aleph Blog)

The Japanese and Swiss economies are feeling the strain of inflated currencies. (The Source)

Canadian income inequality is growing. (Real Time Economics)

Eastern Europe is beginning to feel the Eurozone crisis. (FT)

A day of reckoning awaits Chinese land values. (FT Alphaville)

Economy

Reinhart and Rogoff on debt as an overhang on economic growth. (Bloomberg)

Initial unemployment claims are bouncing around the 400,000 level. (Calculated Risk, CBP)

A closer look at June retail sales. (Bespoke, Global Economic Intersection)

Four cheap ideas to get jobs growth going again. (Atlantic Business)

Earlier on Abnormal Returns

What you missed in our Thursday morning linkfest. (Abnormal Returns)

Mixed media

Save the bees. Buy free-range beef. (The Atlantic)

Abnormal Returns is a founding member of the StockTwits Blog Network.