Quote of the day

Baruch, “Mobile looks subject to the same laws that have governed tech markets throughout history. That law is: no second chances. Value investing in consumer or enterprise tech very very rarely works.” (Ultimi Barbarorum)

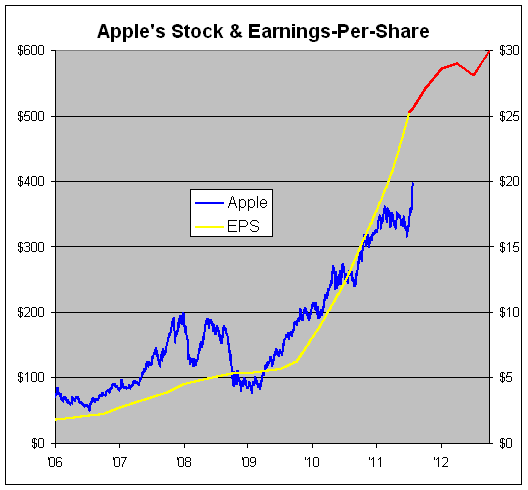

Chart of the day

Apple ($AAPL) earnings in perspective. (Crossing Wall Street)

Markets

What does Apple tell us about the broader market? (Market Anthropology)

What is the big asset class disconnect at the moment? (SurlyTrader)

Hot temperatures are putting the squeeze on the corn crop. (FT)

Strategy

Is gold money? No, it’s an ETF. (The Reformed Broker)

Joe Fahmy, “Don’t marry ANY stock because at the end of the day, they ALL disappoint.” (Joe Fahmy)

On the importance of tuning out the news. (Investing With Options)

IPOs

A crazy start to trading in Zillow ($Z). (TechCrunch)

Hot IPOs do not guarantee a company’s success. (VentureBeat)

Companies

Google ($GOOG) is going to be an active participant in the patent wars. (Deal Journal)

On the Carol Bartz discount at Yahoo! ($YHOO). (Forbes)

Citadel is done with E*Trade ($ETFC) and wants a sale. (WSJ, Dealbreaker)

Does Bank of America ($BAC) need more capital? (Deal Journal, Dealbreaker, Clusterstock)

Are Goldman Sachs’ ($GS) golden days behind it? (WSJ, Deal Journal)

Apple

Once again the “amateur” analysts did a better job forecasting Apple earnings. (Apple 2.0)

An Apple earnings sensitivity analysis. (Global Macro Monitor)

Why Apple should never pay a dividend. (Eric Jackson)

OS X Lion is a big leap forward. (AllThingsD, TechCrunch, Ars Technica)

ETFs

More factor ETFs are coming from Russell. (ETFdb)

How to bulletproof actively managed ETFs. (Forbes)

How much is a company that controls 5% of ETF assets worth? (Focus on Funds)

How does Vanguard manage to run its index funds with so little shortfall? (CBS Moneywatch)

Funds

Quant managers need to be more forthcoming about model risk. (All About Alpha)

The world of investment management is rife with closet indexers. (FT)

Measuring what analysts actually do is tougher than it looks. (the research puzzle)

The big hedge funds that are getting it done in 2011. (Dealbook)

Euro crisis

Gavyn Davies, “[The Eurozone] is not a nation state. And that explains why it is having so much trouble fixing what many economists think should be a relatively straightforward problem.” (FT)

Why the Euro-crisis needs to get worse before it has a chance of getting better. (Credit Writedowns)

“Either the Europeans are willing to fight to keep their union or they aren’t. If they aren’t, they’ll lose it; it’s as simple as that.” (Free exchange, ibid)

The US as a model for currency union. (FT)

Economy

Why hasn’t the unemployment rate for older Americans increased? (Economix)

Don’t expect a return of the bond vigilantes any time soon. (Capital Spectator)

The debt deal, or lack thereof, has killed consumer confidence. (FT Alphaville)

How worried should we be by negative real interest rates? (Bonddad Blog)

Some one is benefiting from lower rates: mortgage refis on the rise. (Calculated Risk)

Earlier on Abnormal Returns

What you missed in our Wednesday morning linkfest. (Abnormal Returns)

The ultimate Apple Q3 earnings linkfest. (Abnormal Returns)

Mixed media

Rationality is overrated by economists. (Aleph Blog)

More evidence on relative preferences. (Falkenblog)

A rave review of Roddy Boyd’s Fatal Risk – A Cautionary Tale of AIG’s Corporate Suicide. (Stone Street Advisors)

Abnormal Returns is a founding member of the StockTwits Blog Network.